| 【英語タイトル】Japan Facility Management Market Size & Share Analysis - Growth Trends and Forecast (2026 - 2031)

|

| ・商品コード:MOR7203RT2288

・発行会社(調査会社):Mordor Intelligence

・発行日:2026年1月

・ページ数:約90

・レポート言語:英語

・レポート形式:PDF

・納品方法:Eメール(受注後2-3営業日)

・調査対象地域:グローバル

・産業分野:ITサービス

|

◆販売価格オプション

(消費税別)

※販売価格オプションの説明

※お支払金額:換算金額(日本円)+消費税

※納期:即日〜2営業日(3日以上かかる場合は別途表記又はご連絡)

※お支払方法:納品日+5日以内に請求書を発行・送付(請求書発行日より2ヶ月以内に銀行振込、振込先:三菱UFJ銀行/H&Iグローバルリサーチ株式会社、支払期限と方法は調整可能)

|

❖ レポートの概要 ❖

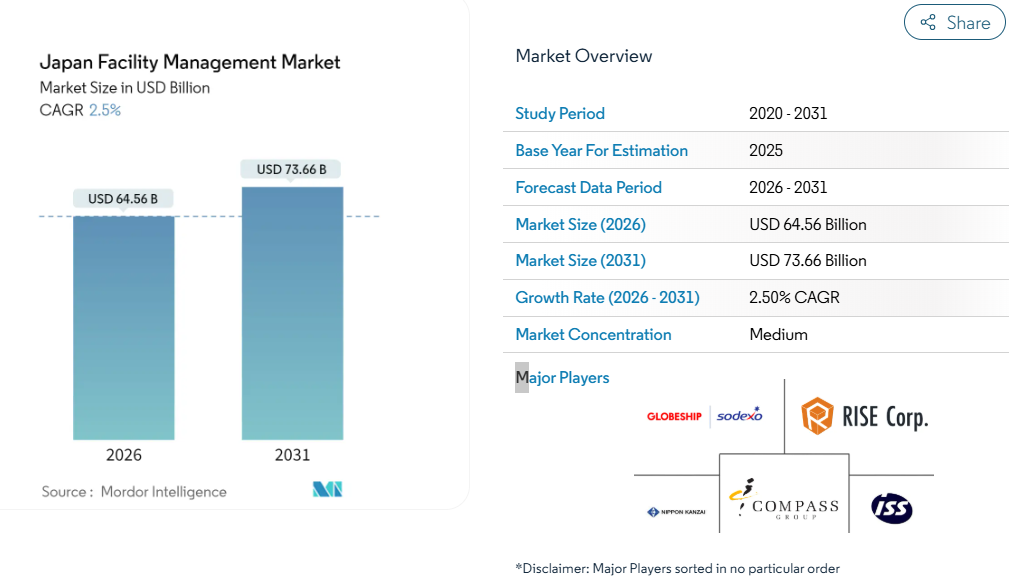

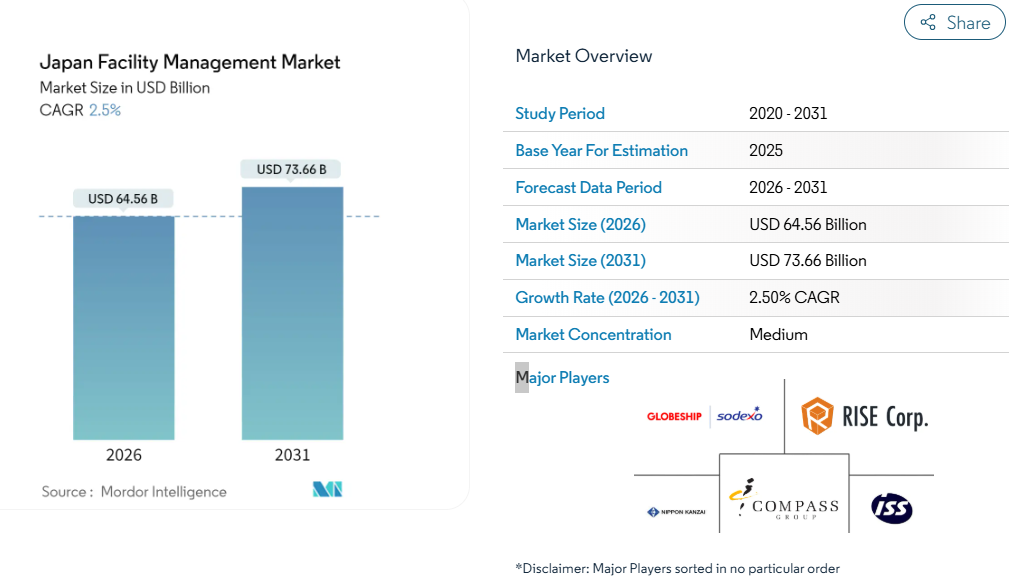

日本のファシリティマネジメント市場は、2025年の約630億ドルから2031年には約737億ドルへと緩やかに拡大すると予測されており、年平均成長率は2.5%程度にとどまる。需要基盤の成熟、人手不足、資材・人件費の上昇が成長を抑制する一方で、業界はテクノロジー活用、耐震改修、エネルギー効率向上といった構造改革を通じて着実に高度化している。ハードサービス(設備保守、空調・電気、消防設備など)は依然として市場の約6割を占めるが、清掃や警備、オフィスサポートなどのソフトサービスは、ウェルネスやホスピタリティ志向の高まりを背景に、より高い成長率を示している。

アウトソーシング型の契約は市場の約7割を占め、企業は運営リスクの移転、ESG対応、専門人材の確保、初期投資の抑制を目的に、統合型FM(IFM)への移行を進めている。特に建設資材価格が2021年以降で3割以上上昇したことが、内製コストを圧迫し、外部委託を後押ししている。大手事業者はM&Aや規模拡大で競争力を維持する一方、IoTセンサー、AI分析、モバイル作業管理などを活用する新興企業が、省人化と効率化を武器に存在感を高めている。

都市部への人口集中は、東京・大阪・名古屋を中心にサービス需要の高度化を促進している。老朽化した建物の増加により、耐震補強や脱炭素対応の改修需要が拡大し、エネルギー管理や長期的な改修支援を含む包括的なFM契約が増えている。統合型FMは、統一されたサービス品質やコストの透明性を求める顧客ニーズに応え、労働力不足の緩和にも寄与している。

一方で、労働人口の減少と高齢化により人件費は上昇しており、2024年には多くの企業が賃上げを実施したものの、人材確保は依然として困難で、倒産件数も増加した。自治体の公共FM入札では価格上限が厳しく、コスト転嫁が難しいため、収益性を圧迫している。

用途別では、オフィスや商業施設などの商業分野が最大の収益源だが、製造業やプロセスプラントではデジタル化と予知保全の導入が進み、最も高い成長率を示している。ホテルや医療、公共インフラなど多様な分野が市場を下支えしている。地域的には東京が技術導入とサービス標準の中心であり、地方では人口減少や分散した施設配置への対応として、遠隔監視やクラウド型管理の重要性が高まっている。全体として、日本のFM市場は緩やかな成長ながら、デジタル化と高度化を軸に持続的な進化を続けている。 |

The Japan Facility Management Market is expected to grow from USD 62.99 billion in 2025 to USD 64.56 billion in 2026 and is forecast to reach USD 73.66 billion by 2031 at 2.5% CAGR over 2026-2031. A maturing demand base, persistent labor shortages, and higher input costs are slowing topline expansion, yet structural reforms are nudging the industry toward technology-enabled service integration, seismic retrofitting programs, and mandatory energy-efficiency upgrades. Hard Services retained dominance, but Soft Services are outpacing the overall market as occupiers raise expectations for hospitality-style amenities, workplace wellness, and data-driven quality control. Outsourced contracts continue to gain traction because clients wish to transfer operational risk, comply with stricter ESG disclosure rules, and access specialized skillsets without capital outlay, especially as record construction-material inflation of 32-35% since 2021 squeezes internal budgets. Competitive intensity is escalating as legacy providers consolidate to defend scale while technology-first entrants leverage IoT sensors, AI-powered analytics, and mobile work order platforms to reduce site visits and combat workforce constraints. These intertwined forces keep the Japan facility management market on a deliberate but unmistakably modernizing path.

Rapid metropolitan concentration is swelling service volumes and complexity across the Japan facility management market as rural depopulation funnels residents and businesses into Tokyo, Osaka, and Nagoya. Commercial real-estate investment in Tokyo alone exceeded JPY 4 trillion in 2025, prompting landlords to upgrade office stock with smart-building infrastructure, wellness amenities, and flexible layouts that raise the operational bar for facility managers. [1] Dense portfolios let providers deploy standardized IoT-enabled building systems and AI-driven predictive maintenance tools across clusters, extracting data-led efficiencies while meeting higher occupant expectations. Urban campuses are thus becoming living laboratories where scalable, technology-rich models are refined before wider rollout. This dynamic, in turn, accelerates consolidation as firms chase critical mass to serve multi-site contracts while absorbing escalating compliance and ESG reporting obligations. Cumulatively, metropolitan growth adds 0.8 percentage points to forecast CAGR, underscoring its pivotal role in sustaining the Japan facility management market.

Segment Analysis

By Service Type: Hard Services Anchor Market Foundation

Hard Services accounted for 60.10% of the Japan facility management market share in 2025. They encompass asset management, MEP and HVAC maintenance, fire-safety systems, and other technical functions essential for operational resilience. Demand remains steady because aging assets must meet tighter seismic and energy-efficiency codes, pushing asset owners to adopt predictive maintenance regimes and retro-commissioning campaigns. Asset-performance dashboards and digital twins help providers prioritize interventions, while IoT-enabled sensors deliver real-time condition data that reduces unscheduled downtime. The Japan facility management market size for Hard Services is expected to expand moderately as providers shift from reactive repairs to outcome-based contracts tied to uptime and energy-saving metrics.

Soft Services, covering cleaning, security, office support, catering, and concierge functions, are growing at a 4.72% CAGR to 2031, faster than Hard Services. Occupier expectations for wellness, hygiene, and hospitality-style amenity packages raise the strategic weight of Soft Services and justify premium pricing. Digital work-order platforms and robotics—such as autonomous floor scrubbers—are improving productivity and mitigating labor constraints. Providers able to fuse hospitality skills with data-driven quality control gain competitive leverage, broadening the revenue mix and accelerating integration across service silos within the Japan facility management market.

By Offering Type: Outsourcing Dominance Accelerates

Outsourced solutions commanded 67.60% of the Japan facility management market size in 2025 and are climbing at 4.12% CAGR as corporations offload non-core operations to specialists. Single-service contracts remain prevalent for basic janitorial or HVAC tasks, but bundled packages and Integrated FM (IFM) grow fastest, offering unified governance, KPI alignment, and technology harmonization across multi-site portfolios. IFM consolidates vendor footprints, enabling better procurement leverage and accountability while supplying clients with consolidated ESG metrics. The trend reflects board-level emphasis on operational resilience, risk transfer, and data visibility.

In-house management still holds a 32.40% share, primarily among asset-heavy conglomerates with legacy capability or mission-critical confidentiality needs. However, rising technological complexity and wage escalation pressure internal teams to adopt hybrid arrangements, subcontracting specialized tasks such as predictive analytics or vertical-transport maintenance. In-house operators increasingly deploy AI building-management systems and IoT sensor networks to stay cost-competitive, yet the structural drift toward outsourcing remains clear across the Japan facility management market.

By End-user Industry: Commercial Leadership Faces Industrial Challenge

Commercial facilities—spanning offices, retail, and warehousing—held 39.70% of total revenues in 2025 as corporate tenants sought workplace modernization, energy optimization, and occupant-experience enhancements. IT and telecom sites demand high-availability services, redundancy planning, and regulatory compliance around data security; retail centers focus on foot-traffic flows, asset protection, and experiential upgrades; warehouse operators prioritize throughput and environmental monitoring. These varied needs sustain robust spending yet expose providers to occupancy swings inherent in consumer demand cycles.

Industrial and process plants are posting the fastest growth at 4.63% CAGR due to manufacturing digitalization and predictive maintenance adoption. Production downtime carries steep financial penalties, pushing plant managers toward sensor-rich, data-visible facility programs that maximize uptime and comply with stringent safety mandates. Energy and mining projects also require specialist skills in hazardous-area management, environmental mitigation, and emergency response. As industry 4.0 initiatives proliferate, industrial sites will narrow the revenue gap with commercial properties within the Japan facility management market.

Hospitality assets—hotels, restaurants, and entertainment venues—demand guest-centric service quality, rapid issue resolution, and brand protection. Healthcare institutions require infection-control protocols, statutory compliance, and equipment uptime guarantees. Institutional and public-infrastructure operators—schools, transport hubs, museums—offer stable but price-sensitive revenue streams. Collectively, these verticals diversify provider portfolios and buffer macroeconomic volatility.

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators – Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Japan’s Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Urbanisation and population growth in major metros

- 4.2.2 Profitability rates of major FM players

- 4.2.3 Current occupancy rates

- 4.2.4 Regulatory drivers specific to labour and safety standards

- 4.2.5 Growth in outsourcing to Integrated FM contracts

- 4.2.6 Aging building stock driving seismic and sustainability retrofits

- 4.3 Market Restraints

- 4.3.1 Workforce indicators – labour participation

- 4.3.2 Sector investment priorities in infrastructure pipeline

- 4.3.3 Rising labour costs amid ageing workforce

- 4.3.4 Stringent bid-price caps in public FM tenders

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter’s Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5. MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Globeship Sodexo

- 6.4.2 Compass Group Japan

- 6.4.3 RISE Corp. Tokyo

- 6.4.4 Nippon Kanzai Co.

- 6.4.5 ISS Facility Services Japan

- 6.4.6 Aramark Facilities Services Japan

- 6.4.7 G4S Facilities Management Japan

- 6.4.8 SECOM Co., Ltd.

- 6.4.9 Tokai Building Maintenance Co., Ltd.

- 6.4.10 Yamato Facility Co., Ltd.

- 6.4.11 Kanden Facilities

- 6.4.12 MC Facilities

- 6.4.13 Sagawa Express (FM Division)

- 6.4.14 Asahi Facilities Inc.

- 6.4.15 Tokyu Community Corporation

- 6.4.16 Mitsubishi Estate Property Management

- 6.4.17 Kajima Building Systems

- 6.4.18 ALSOK (Sohgo Security Services)

- 6.4.19 JLL Japan

- 6.4.20 CBRE Group Japan

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)