| 【英語タイトル】Connected Car Market by Service ICE & EV (OTA, Navigation, Multimedia Streaming, Social Media, eCall, Autopilot, Remote Diagnostics, Home Integration), Market (OEM, Aftermarket), Network, Form, Transponder, Hardware and Region - Global Forecast to 2030

|

| ・商品コード:AT 5974

・発行会社(調査会社):MarketsandMarkets

・発行日:2024年6月

・ページ数:350

・レポート言語:英語

・レポート形式:PDF

・納品方法:Eメール(受注後1営業日)

・調査対象地域:グローバル

・産業分野:自動車、IT

|

◆販売価格オプション

(消費税別)

※販売価格オプションの説明

※お支払金額:換算金額(日本円)+消費税

※納期:即日〜2営業日(3日以上かかる場合は別途表記又はご連絡)

※お支払方法:納品日+5日以内に請求書を発行・送付(請求書発行日より2ヶ月以内に銀行振込、振込先:三菱UFJ銀行/H&Iグローバルリサーチ株式会社、支払期限と方法は調整可能)

|

❖ レポートの概要 ❖

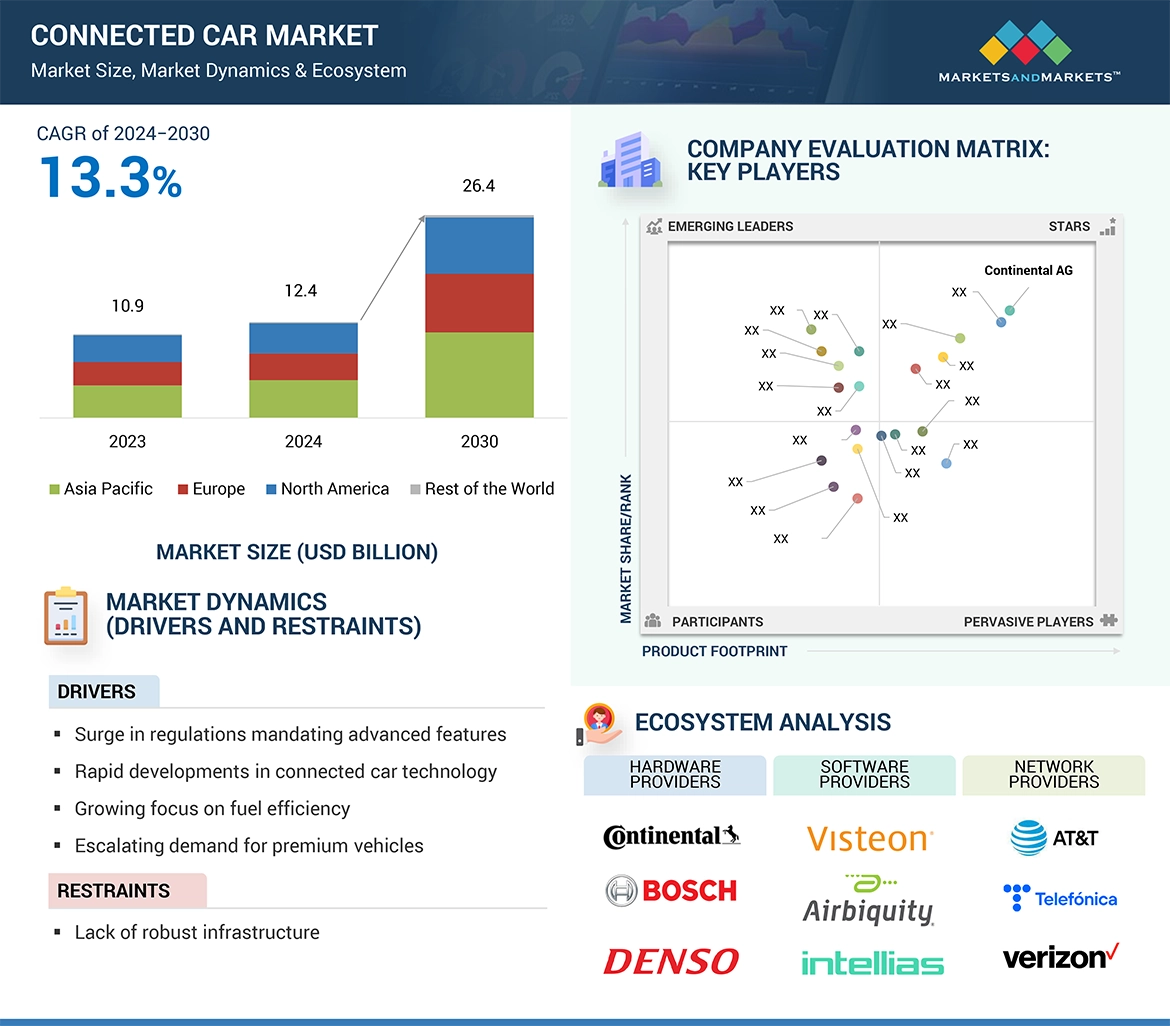

世界のコネクテッドカー市場は、2024年の124億ドルから2030年までに264億ドルへと成長し、年平均成長率(CAGR)13.3%に達すると予測されている。この急成長は、テクノロジーに精通した消費者による常時接続への強い需要と、5GネットワークやAI搭載機能といった技術の急速な進展によって牽引されている。また、米国運輸省によるV2V(車車間通信)技術の義務化のような政府規制、自動化やライドシェアリングサービスの普及、高級車を中心とした自動車販売の増加も市場成長を後押ししている。

市場の主要な推進要因は、テレマティクスと使用量ベース保険(UBI)の採用拡大である。テレマティクスは運転行動の改善やUBIによる保険料最適化に寄与し、GSMAは2030年までに7500億ドル規模の産業になると推定している。EUやロシアでの緊急通報(eCall)義務化といった政府の動きも、この成長を支えている。

一方で、市場の制約も存在する。特に高速道路や、メキシコ、ブラジル、インドなどの発展途上国において、4G-LTEや5Gといった堅牢な通信インフラが不足している点が課題である。また、サイバーセキュリティは最大の懸念事項である。車両の重要システム(ブレーキ、ステアリング等)へのリモートハッキング(2015年のJeepハッキング事例など)や、収集される個人データ漏洩のリスクがある。信頼確保のためには、強力な暗号化や国際基準の確立が不可欠である。

大きな市場機会としては、ライドシェアリングとモビリティサービスの発展が挙げられる。テスラやWaymoがリードする自動運転技術は、ドライバー不要の「ロボタクシー」を実現し、1マイルあたり0.18ドルといった圧倒的な低コスト運用を可能にする。これは既存のライドシェアリング市場(1マイル2〜3ドル)を破壊する可能性を秘めている。

市場セグメント別では、「組み込み(Embedded)」型が最大のシェアを占める。車両へのシームレスな統合、eCallなどの規制対応、OTA(Over-the-Air)アップデートや遠隔診断といったクラウドサービス提供に適しているためだ。テスラはこの代表例である。また、成長性の観点では「アフターマーケット」分野が最も急速に成長している。OBD-IIドングルなど、既存車両に安価で接続機能を追加でき、幅広い消費者に普及している。Uberなどのフリート管理にも活用されている。

地域別では、アジア太平洋地域が最大の市場シェアを誇る。急速な都市化、スマートシティへの投資、5G/AIの導入が背景にある。特に世界最大の自動車市場である中国が牽引役であり、GeelyやBYDなどが先進的機能を積極的に採用している。

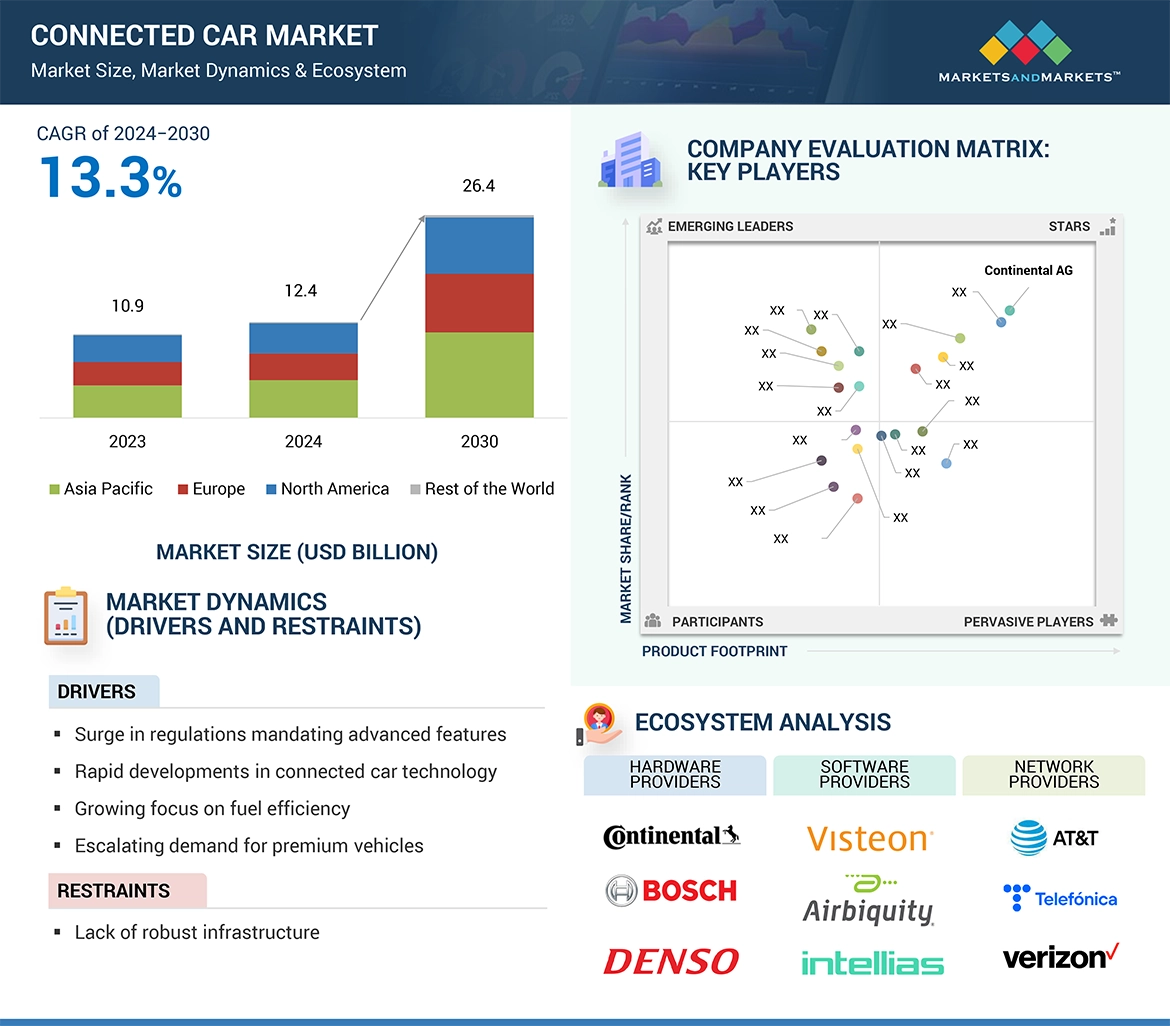

この市場の主要企業には、Continental AG(独)、Robert Bosch GmbH(独)、Harman International(米)、Visteon(米)などが含まれる。2024年2月にはContinentalがタイヤ管理用デジタルツールを、Harmanが5G対応TCU(テレマティクス制御ユニット)を発表するなど、技術革新が続いている。 |

The global connected car market is projected to grow from USD 12.4 Billion in 2024 to USD 26.4 Billion by 2030 at a CAGR of 13.3%. The connected car market is experiencing exponential growth, driven by various factors. Foremost is the surging consumer demand for constant connectivity and reliance on technology, particularly among tech-savvy populations. This insatiable need for connectivity is being met by rapid advancements in automotive technology, such as the rollout of 5G networks and AI-powered features. Governments are also playing a catalyzing role, with regulations like the US Department of Transportation’s mandate for vehicle-to-vehicle communication technology in new cars. The popularity of automation, ridesharing, and mobility services is further propelling the market. Finally, the increasing production and sales of vehicles, especially luxury models, supplement this dynamic sector’s growth.

DRIVER: Increasing Adoption of Telematics and usage-based Insurance

Telematics has merged into the automotive mainstream at a rapid rate. Car telematics help improve driving behavior and road safety and align insurance premiums via usage-based insurance (UBI). According to GSMA (Global System for Mobile Communications), the telematics industry is estimated to reach USD 750 billion by 2030. There are two significant reasons for the growth of the telematics industry. First is governments’ increasing willingness to mandate telematics services such as emergency-call capabilities, which is already happening in the European Union and Russia. Second is the increasing demand for excellent connectivity and intelligence in vehicles. Also, the automotive telematics market is projected to grow from USD 9,041.6 million in 2024 to USD 16,111.0 million by 2030, at a CAGR of 10.1% from 2024 to 2030. This growth is driven by the increasing demand for vehicles with telematics services, growing concerns regarding safety in the event of breakdown and accidents, rising demand for advanced technologies, and the high purchasing power of consumers. Stolen vehicle assistance, insurance-based assessment, and other advanced services are aiding manufacturers in enhancing vehicles’ overall safety and efficiency.

RESTRAINT: Lack of infrastructure for the proper functioning of connected cars

Vehicles are not connected to the cloud or one other because of the restricted network connectivity on highways. Compared to industrialized economies, the expansion of IT infrastructure on highways is occurring more slowly in developing nations like Mexico, Brazil, and India. The necessary 4G-LTE and 3G communication networks are only available in urban and semi-urban areas. Low connection is a problem even though many third-party logistics companies operate in rural and semi-urban areas. As a result, developing the connected automobile industry in developing nations may need more IT and communication infrastructure in these areas and a delay in governmental regulations. Additionally, industry participants may be subject to national telecom laws, such as those about legal intercept and in-country entity requirements, as telecom service providers. It will be necessary to discuss and regulate the cross-border use cases and the interoperability of the various platforms. Our reliance on data networks also brings up the issue of net neutrality—in which internet service providers give some data transmission priority.