| 【英語タイトル】Exosomes Market Forecasts to 2030 - Global Analysis By Product (Exosome Isolation Kits, Exosome Detection and Characterization Kits and Other Products), Source, Technique, End User and By Geography

|

| ・商品コード:SMRC903FF382

・発行会社(調査会社):Stratistics MRC

・発行日:2025年1月

・ページ数:約150

・レポート言語:英語

・レポート形式:PDF

・納品方法:Eメール(受注後2-3営業日)

・調査対象地域:グローバル

・産業分野:医療

|

◆販売価格オプション

(消費税別)

※販売価格オプションの説明

※お支払金額:換算金額(日本円)+消費税

※納期:即日〜2営業日(3日以上かかる場合は別途表記又はご連絡)

※お支払方法:納品日+5日以内に請求書を発行・送付(請求書発行日より2ヶ月以内に銀行振込、振込先:三菱UFJ銀行/H&Iグローバルリサーチ株式会社、支払期限と方法は調整可能)

|

❖ レポートの概要 ❖

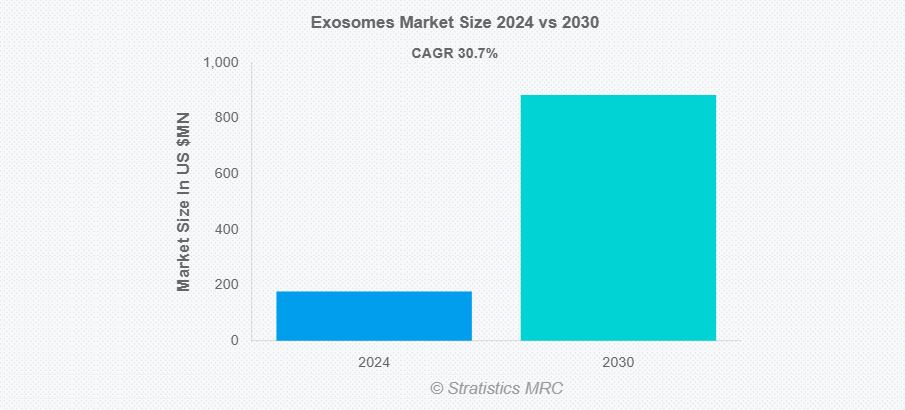

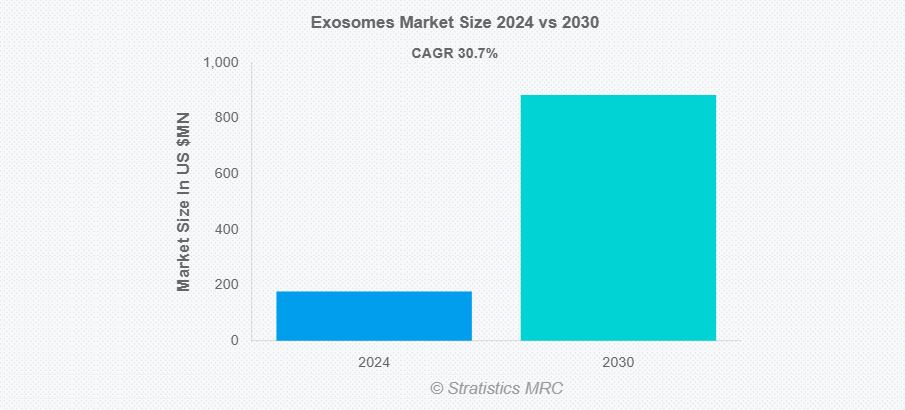

2024年の世界のエクソソーム市場規模は1億7740万ドルで、2030年には8億8431万ドルに達すると予測されており、予測期間中の年平均成長率(CAGR)は30.7%と見込まれています。エクソソームは細胞から分泌される非常に小さな膜構造の小胞で、タンパク質、脂質、核酸などの生理活性物質を含み、細胞間の情報伝達を担っています。がんや神経変性疾患、感染症などの病態にも関与しており、診断や創薬分野での応用が注目されています。

市場の成長要因としては、エクソソームの高い生体適合性と低い免疫原性を活かした薬剤送達システムとしての応用が進んでいる点が挙げられます。特にRNAやタンパク質、小分子薬剤の搭載に関する技術革新が進み、精密医療への貢献が期待されています。一方、開発コストの高さが市場参入の障壁となっており、中小企業の参入や製品の普及を妨げています。

しかし、治療選択肢の少ない希少疾患への応用では大きな可能性があり、血液脳関門を通過できる特性などが注目されています。一方で、特許を巡る知的財産権の争いは、市場の成長スピードを遅らせる要因ともなっています。

COVID-19の影響により、ウイルスの感染機構の解明やワクチン開発においてエクソソーム関連研究が加速し、市場にプラスの影響を与えました。今後の成長が期待される製品には、非侵襲的診断技術への需要の高まりを背景に、高品質なエクソソームを効率的に分離できる「エクソソーム分離キット」があり、この分野が市場拡大をけん引するとみられています。

また、最も高い成長率が見込まれるのは診断ラボ部門であり、がんや神経変性疾患などの早期診断においてエクソソーム中のバイオマーカーを活用する技術の進展が寄与しています。

地域別では、アジア太平洋地域が診断・治療・ドラッグデリバリーにおけるエクソソームの利用拡大とバイオ技術の進展により最大の市場シェアを占めると予測され、特に中国、日本、インドの成長が著しいです。一方、北米は再生医療や個別化治療の研究が進んでおり、最も高いCAGRが見込まれています。

主要企業には、Evox Therapeutics、EXO Biologics、Thermo Fisher Scientificなどがあり、近年ではEXO BiologicsによるExoPulseプラットフォームのライセンス提供や、EvoxによるCodiak Biosciencesの技術買収など、積極的な提携・買収が進んでいます。製品は分離キット、診断キット、治療用製品などに分類され、用途や供給源、技術、エンドユーザー別にも多様な市場が広がっています。 |

According to Stratistics MRC, the Global Exosomes Market is accounted for $177.4 million in 2024 and is expected to reach $884.31 million by 2030 growing at a CAGR of 30.7% during the forecast period. Exosomes are tiny, membrane-bound extracellular vesicles secreted by various cell types into bodily fluids. Typically 30-150 nanometres in diameter, they carry bioactive molecules such as proteins, lipids, and nucleic acids, serving as intercellular communication vehicles. Exosomes play crucial roles in physiological processes, including immune responses and tissue repair, as well as pathological conditions like cancer, neurodegenerative diseases, and infections. Their unique properties have made them a focus in diagnostics and therapeutic delivery systems, offering potential for precision medicine applications.

According to the American Cancer Society, an estimated 1.9 million new cancer cases and 609,360 cancer deaths were recorded by the end of 2022.

Market Dynamics:

Driver:

Growing applications in drug delivery

Exosomes serve as natural carriers for targeted drug delivery, offering high biocompatibility and low immunogenicity. Their ability to encapsulate therapeutic molecules, such as RNA, proteins, and small drugs, enhances treatment efficacy. Moreover, advancements in engineering exosomes to improve drug-loading capacity and targeting precision have fuelled their adoption. Pharmaceutical companies are increasingly investing in exosome-based drug delivery systems, recognizing their potential for precision medicine. This trend is expected to significantly boost market growth in the coming years.

Restraint:

High cost of research and development

Developing exosome-based therapies and diagnostics requires substantial investment in advanced technologies, clinical trials, and regulatory approvals. These expenses often limit the ability of smaller companies and startups to enter the market. Moreover, the long development timeline increases financial risks, discouraging potential investors. High R&D costs also lead to increased prices for end products, making them less accessible to healthcare providers and patients. Consequently, the overall growth and widespread adoption of exosome-based innovations face considerable delays and obstacles.

Opportunity:

Therapeutic potential in rare diseases

Exosomes act as natural carriers for focused providing novel solutions for diseases, drug delivery with few therapy alternatives. Their capacity to traverse biological barriers, such as the blood-brain barrier, increases their usefulness in treating complex uncommon diseases. Furthermore, advances in exosome isolation and engineering have permitted the development of targeted medicines. Growing interest in personalized medicine and orphan drug development further propels research and investment in this field. Consequently, the exosome market is witnessing robust expansion due to its transformative potential in treating rare diseases.

Threat:

Intellectual property disputes

Patent conflicts can delay the development and commercialization of new exosome-based therapies and diagnostic tools. Companies involved in litigation often face increased legal costs, diverting resources from research and development. IP disputes can also lead to exclusivity in the market, limiting competition and driving up prices. Smaller firms may struggle to enter the market due to patent protections held by larger players. Overall, these disputes slow down the growth and accessibility of exosome-based products and services.

Covid-19 Impact

The COVID-19 pandemic positively impacted the exosomes market. The pandemic prompted an unprecedented surge in research efforts to understand the virus. Exosomes, being small vesicles involved in cell communication, were studied to better understand the virus’s mechanisms of infection and its effects on host cells. This led to increased demand for exosome-related research tools and diagnostics for studying COVID-19. Additionally, several COVID-19 vaccines were developed and authorized for emergency use during the pandemic.

The exosome isolation kits segment is expected to be the largest during the forecast period

The exosome isolation kits segment is estimated to have a lucrative growth, due to the efficient and reliable methods for isolating exosomes from various biological samples. These kits enable researchers to extract high-quality exosomes, essential for downstream applications such as diagnostics and therapeutics. With increasing demand for non-invasive diagnostic methods, these kits support liquid biopsy advancements, a key growth area. Moreover, the growing emphasis on personalized medicine further drives the need for precise exosome isolation tools. As a result, the exosome isolation kit segment contributes significantly to market expansion by enhancing the accuracy and scope of exosome-related research and applications.

The diagnostic laboratories segment is expected to have the highest CAGR during the forecast period

The diagnostic laboratories segment is anticipated to witness the highest CAGR growth during the forecast period, by leveraging their potential in non-invasive diagnostics. Exosomes contain biomarkers like proteins, lipids, and nucleic acids that aid in detecting diseases at an early stage. These laboratories utilize advanced technologies to isolate and analyze exosomes, enabling precise diagnosis of cancer, neurodegenerative disorders, and cardiovascular diseases. Collaborations between labs and biotech firms enhance the development of innovative exosome-based diagnostic tools. As awareness of exosome applications grows, diagnostic laboratories are becoming pivotal in expanding the exosomes market globally.

Region with largest share:

Asia Pacific is expected to hold the largest market share during the forecast period due to increased applications of exosomes in diagnostics, therapeutics, and drug delivery. Advances in biotechnology and the growing focus on personalized medicine are key drivers. Countries like China, Japan, and India are witnessing rapid advancements in exosome-based research and commercialization. The demand for non-invasive diagnostic techniques and the rising prevalence of diseases such as cancer and neurodegenerative disorders are further fuelling market expansion. Additionally, the presence of a robust healthcare infrastructure and increasing investments are boosting market opportunities in this region.

Region with highest CAGR:

North America is expected to have the highest CAGR over the forecast period, owing to advancements in biotechnology, increasing research in regenerative medicine, and rising demand for personalized therapies. Exosomes, as carriers of RNA, proteins, and lipids, are crucial in diagnostics and drug delivery systems. The market is benefiting from the expanding applications in cancer treatment, neurological disorders, and immunotherapy. Additionally, robust support from research institutions and healthcare funding in the U.S. and Canada is propelling innovation.

Key players in the market

Some of the key players profiled in the Exosomes Market include Evox Therapeutics, Capricor Therapeutics, EXO Biologics, Aethlon Medical, Coya Therapeutics, Aegle Therapeutics Corporation, Aragen Bioscience, RoosterBio, Inc., Bio-Techne, Thermo Fisher Scientific, Inc., Danaher and Hologic Inc.

Key Developments:

In June 2024, EXO Biologics announced ongoing partnerships with multiple entities in Europe and the US, emphasizing their strategy to license the ExoPulse platform to accelerate drug development. This approach allows EXO Biologics to focus on direct drug development while enabling ExoXpert to support other companies through licensing agreements.

In April 2024, ExoXpert, a subsidiary of EXO Biologics, entered a strategic partnership with Neucore Bio. This collaboration focuses on evaluating advanced exosome loading using ExoXpert’s ExoPulse platform to optimize the delivery of proprietary payloads into exosomes.

In July 2023, Evox completed the acquisition of Codiak Biosciences’ engEx-AAV™ technology platform. This acquisition includes all intellectual property rights associated with the technology, which facilitates the active loading of adeno-associated virus (AAV) into exosomes, thereby improving delivery efficacy and shielding AAVs from neutralizing antibodies

Products Covered:

• Exosome Isolation Kits

• Exosome Detection and Characterization Kits

• Exosome Therapeutics

• Exosome Diagnostic Kits

• Other Products

Sources Covered:

• Human-Derived Exosomes

• Animal-Derived Exosomes

• Plant-Derived Exosomes

Techniques Covered:

• Exosome Isolation Techniques

• Exosome Characterization Techniques

End Users Covered:

• Pharmaceutical and Biopharmaceutical Companies

• Academic and Research Institutes

• Diagnostic Laboratories

• Contract Research Organizations (CROs)

• Hospitals and Clinics

• Other End Users

Regions Covered:

• North America

o US

o Canada

o Mexico

• Europe

o Germany

o UK

o Italy

o France

o Spain

o Rest of Europe

• Asia Pacific

o Japan

o China

o India

o Australia

o New Zealand

o South Korea

o Rest of Asia Pacific

• South America

o Argentina

o Brazil

o Chile

o Rest of South America

• Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Rest of Middle East & Africa

1 Executive Summary

2 Preface

2.1 Abstract

2.2 Stake Holders

2.3 Research Scope

2.4 Research Methodology

2.4.1 Data Mining

2.4.2 Data Analysis

2.4.3 Data Validation

2.4.4 Research Approach

2.5 Research Sources

2.5.1 Primary Research Sources

2.5.2 Secondary Research Sources

2.5.3 Assumptions

3 Market Trend Analysis

3.1 Introduction

3.2 Drivers

3.3 Restraints

3.4 Opportunities

3.5 Threats

3.6 Product Analysis

3.7 End User Analysis

3.8 Emerging Markets

3.9 Impact of Covid-19

4 Porters Five Force Analysis

4.1 Bargaining power of suppliers

4.2 Bargaining power of buyers

4.3 Threat of substitutes

4.4 Threat of new entrants

4.5 Competitive rivalry

5 Global Exosomes Market, By Product

5.1 Introduction

5.2 Exosome Isolation Kits

5.3 Exosome Detection and Characterization Kits

5.4 Exosome Therapeutics

5.5 Exosome Diagnostic Kits

5.6 Other Products

6 Global Exosomes Market, By Source

6.1 Introduction

6.2 Human-Derived Exosomes

6.3 Animal-Derived Exosomes

6.4 Plant-Derived Exosomes

7 Global Exosomes Market, By Technique

7.1 Introduction

7.2 Exosome Isolation Techniques

7.2.1 Ultracentrifugation

7.2.2 Size Exclusion Chromatography (SEC)

7.2.3 Immunoaffinity Capture

7.2.4 Precipitation-Based Techniques

7.2.5 Microfluidic Technology

7.3 Exosome Characterization Techniques

7.3.1 Nanoparticle Tracking Analysis (NTA)

7.3.2 Electron Microscopy (EM)

7.3.3 Western Blotting

7.3.4 Flow Cytometry

7.3.5 Enzyme-Linked Immunosorbent Assay (ELISA)

8 Global Exosomes Market, By End User

8.1 Introduction

8.2 Pharmaceutical and Biopharmaceutical Companies

8.3 Academic and Research Institutes

8.4 Diagnostic Laboratories

8.5 Contract Research Organizations (CROs)

8.6 Hospitals and Clinics

8.7 Other End Users

9 Global Exosomes Market, By Geography

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 Italy

9.3.4 France

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Australia

9.4.5 New Zealand

9.4.6 South Korea

9.4.7 Rest of Asia Pacific

9.5 South America

9.5.1 Argentina

9.5.2 Brazil

9.5.3 Chile

9.5.4 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Qatar

9.6.4 South Africa

9.6.5 Rest of Middle East & Africa

10 Key Developments

10.1 Agreements, Partnerships, Collaborations and Joint Ventures

10.2 Acquisitions & Mergers

10.3 New Product Launch

10.4 Expansions

10.5 Other Key Strategies

11 Company Profiling

11.1 Evox Therapeutics

11.2 Capricor Therapeutics

11.3 EXO Biologics

11.4 Aethlon Medical

11.5 Coya Therapeutics

11.6 Aegle Therapeutics Corporation

11.7 Aragen Bioscience

11.8 RoosterBio, Inc.

11.9 Bio-Techne

11.10 Thermo Fisher Scientific, Inc.

11.11 Danaher

11.12 Hologic Inc.

List of Tables

1 Global Exosomes Market Outlook, By Region (2022-2030) ($MN)

2 Global Exosomes Market Outlook, By Product (2022-2030) ($MN)

3 Global Exosomes Market Outlook, By Exosome Isolation Kits (2022-2030) ($MN)

4 Global Exosomes Market Outlook, By Exosome Detection and Characterization Kits (2022-2030) ($MN)

5 Global Exosomes Market Outlook, By Exosome Therapeutics (2022-2030) ($MN)

6 Global Exosomes Market Outlook, By Exosome Diagnostic Kits (2022-2030) ($MN)

7 Global Exosomes Market Outlook, By Other Products (2022-2030) ($MN)

8 Global Exosomes Market Outlook, By Source (2022-2030) ($MN)

9 Global Exosomes Market Outlook, By Human-Derived Exosomes (2022-2030) ($MN)

10 Global Exosomes Market Outlook, By Animal-Derived Exosomes (2022-2030) ($MN)

11 Global Exosomes Market Outlook, By Plant-Derived Exosomes (2022-2030) ($MN)

12 Global Exosomes Market Outlook, By Technique (2022-2030) ($MN)

13 Global Exosomes Market Outlook, By Exosome Isolation Techniques (2022-2030) ($MN)

14 Global Exosomes Market Outlook, By Ultracentrifugation (2022-2030) ($MN)

15 Global Exosomes Market Outlook, By Size Exclusion Chromatography (SEC) (2022-2030) ($MN)

16 Global Exosomes Market Outlook, By Immunoaffinity Capture (2022-2030) ($MN)

17 Global Exosomes Market Outlook, By Precipitation-Based Techniques (2022-2030) ($MN)

18 Global Exosomes Market Outlook, By Microfluidic Technology (2022-2030) ($MN)

19 Global Exosomes Market Outlook, By Exosome Characterization Techniques (2022-2030) ($MN)

20 Global Exosomes Market Outlook, By Nanoparticle Tracking Analysis (NTA) (2022-2030) ($MN)

21 Global Exosomes Market Outlook, By Electron Microscopy (EM) (2022-2030) ($MN)

22 Global Exosomes Market Outlook, By Western Blotting (2022-2030) ($MN)

23 Global Exosomes Market Outlook, By Flow Cytometry (2022-2030) ($MN)

24 Global Exosomes Market Outlook, By Enzyme-Linked Immunosorbent Assay (ELISA) (2022-2030) ($MN)

25 Global Exosomes Market Outlook, By End User (2022-2030) ($MN)

26 Global Exosomes Market Outlook, By Pharmaceutical and Biopharmaceutical Companies (2022-2030) ($MN)

27 Global Exosomes Market Outlook, By Academic and Research Institutes (2022-2030) ($MN)

28 Global Exosomes Market Outlook, By Diagnostic Laboratories (2022-2030) ($MN)

29 Global Exosomes Market Outlook, By Contract Research Organizations (CROs) (2022-2030) ($MN)

30 Global Exosomes Market Outlook, By Hospitals and Clinics (2022-2030) ($MN)

31 Global Exosomes Market Outlook, By Other End Users (2022-2030) ($MN)