-

Introduction

-

Research Methodology

-

Executive Summary

-

Premium Insights

-

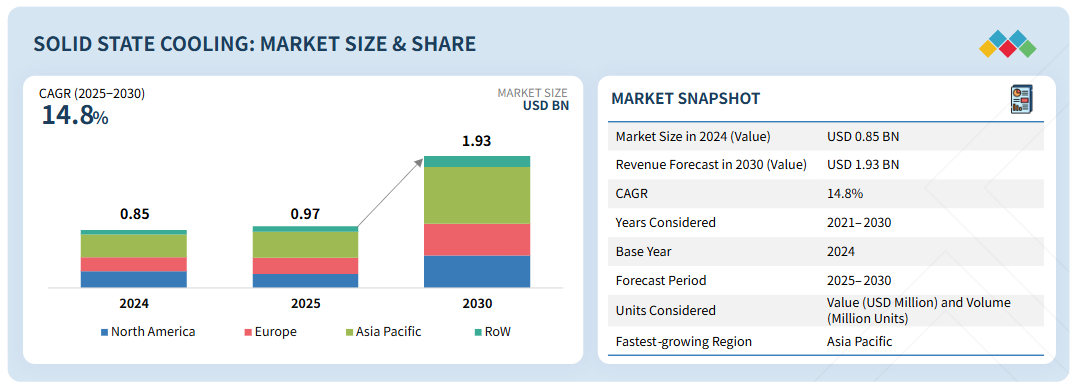

Market Overview

5.1 Introduction

5.2 Market Dynamics

-

Drivers

-

Surging demand for energy-efficient cooling solutions

-

Rising implementation of IoT-enabled smart home devices

-

Growing adoption of electric and hybrid electric vehicles

-

Thriving data center industry

-

-

Restraints

-

High initial investment and manufacturing costs of solid-state cooling technology

-

Integration complexity with existing systems and infrastructure

-

Regulatory barriers and standards compliance requirements

-

-

Opportunities

-

Growing deployment in aerospace, defense, and consumer sectors

-

Expanding industrialization and urbanization

-

-

Challenges

-

Design and engineering complexity of solid-state cooling systems

-

Shortage of qualified technical experts

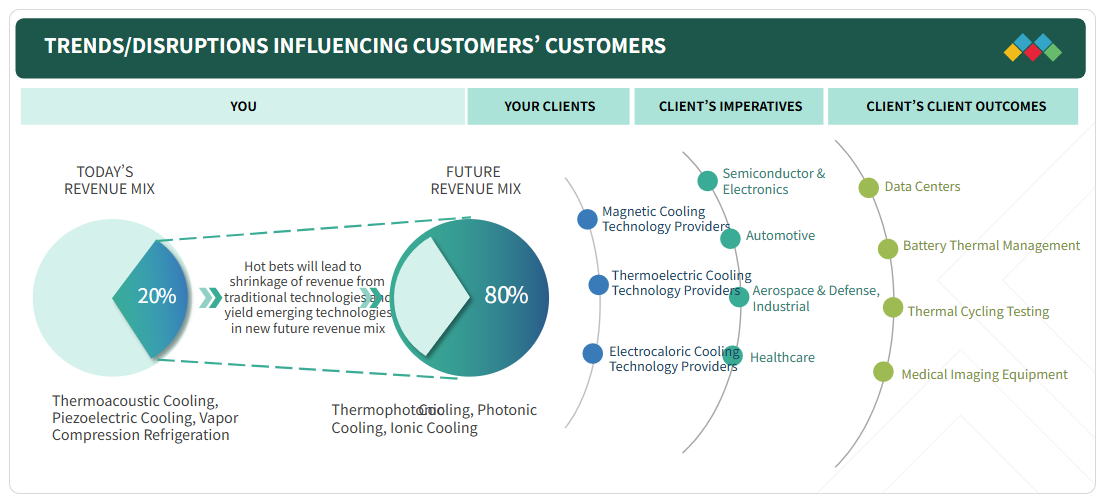

5.3 Trends/Disruptions Impacting Customer Business

5.4 Pricing Analysis

-

-

Average selling price of chillers, by key player (2024)

-

Average selling price trend of chillers, by region (2020–2024)

5.5 Value Chain Analysis

5.6 Ecosystem Analysis

5.7 Investment and Funding Scenario

5.8 Technology Analysis -

Key Technologies

-

Thermoelectric cooling

-

Magnetic cooling

-

Electrocaloric cooling

-

Thermoelastic cooling

-

-

Complementary Technologies

-

Heat exchangers

-

Thermal interface materials (TIMs)

-

Temperature sensors and control systems

-

Power electronics and drivers

-

-

Adjacent Technologies

-

Thermal management solutions

-

Energy harvesting systems

5.9 Patent Analysis

5.10 Trade Analysis

-

-

Import data

-

Export data

5.11 Key Conferences and Events (2025–2026)

5.12 Case Study Analysis -

Intel: Integrating Phononic’s solid-state cooling in data centers

-

Thermo Fisher Scientific: Using TE Technology modules in ultra-low temperature freezers

-

BMW Group: Implementing II-VI Marlow thermoelectric modules in EVs

-

Philips Healthcare: Integrating Laird modules in medical imaging equipment

-

NASA: Partnering with ATG for space-mission solid-state cooling systems

5.13 Standards and Regulatory Landscape -

Regulatory bodies, government agencies, and other organizations

-

Standards and regulations related to the solid-state cooling market

-

IEC standards

-

UL standards

-

ISO standards

-

ENERGY STAR certification

-

Safety regulations

5.14 Porter’s Five Forces Analysis

-

-

Threat of new entrants

-

Threat of substitutes

-

Bargaining power of suppliers

-

Bargaining power of buyers

-

Intensity of competitive rivalry

5.15 Key Stakeholders and Buying Criteria -

Key stakeholders in the buying process

-

Buying criteria

5.16 Impact of 2025 US Tariff on the Solid-State Cooling Market

5.16.1 Introduction

5.16.2 Key tariff rates

5.16.3 Price impact analysis

5.16.4 Impact by country/region -

US

-

Europe

-

Asia Pacific

5.16.5 Impact on verticals

-

Components of Solid-State Cooling Systems

6.1 Introduction

6.2 Refrigeration System Components

-

TEC modules (refrigeration-grade)

-

Compact control units

-

Thermal interface materials

-

Other refrigeration-system components

6.3 Cooling System Components -

High-capacity TEC modules / cascade TECs

-

Smart control boards

-

Heat spreaders & heat sinks

-

Thermal interface materials

-

Other cooling-system components

-

Solid-State Cooling Market, by Product

7.1 Introduction

7.2 Refrigeration Systems

-

Refrigerators

-

Materials science, semiconductor, and thermal-management advancements driving growth

-

-

Freezers

-

Rising demand for energy-efficient and eco-friendly cooling solutions

7.3 Cooling Systems

-

-

Air conditioners

-

Demand for precise control and minimal maintenance

-

-

Coolers

-

Demand for compact, high-power electronics creating growth opportunities

-

-

Chillers

-

Need for precise temperature control in medical equipment

-

-

Solid-State Cooling Market, by Technology

8.1 Introduction

8.2 Thermoelectric Cooling

-

Expanding applications in consumer electronics, automotive, and medical devices

-

Types of thermoelectric cooling

-

Single-stage

-

Multi-stage

-

Thermocycler

8.3 Electrocaloric Cooling

-

-

Climate-friendly cooling and fast response time

8.4 Magnetocaloric Cooling -

Low energy consumption and reduced noise levels

8.5 Other Technologies

-

Solid-State Cooling Market, by Vertical

9.1 Introduction

9.2 Automotive

-

EV adoption accelerating growth opportunities

-

Case study: BMW + Gentherm (personalized climate control)

-

Impact analysis of technology types on automotive

9.3 Consumer Electronics & Semiconductor -

Edge computing and always-on IoT/mobile features driving demand

-

Case study: Intel + Tark Thermal Solutions (CPU thermal management)

-

Impact analysis of technology types on consumer electronics & semiconductor

9.4 Healthcare -

Focus on temperature-management challenges and patient care

-

Case study: Pfizer + Phononic (vaccine storage units)

-

Impact analysis of technology types on healthcare

9.5 Other Verticals -

Case study: Boeing + Laird Thermal Systems (aircraft avionics)

-

Impact analysis of technology types on other verticals

-

Solid-State Cooling Market, by Region

10.1 Introduction

10.2 North America

-

Macroeconomic outlook

-

United States: more construction projects boosting demand

-

Canada: growing data center investments

-

Mexico: rapid urbanization and infrastructure development

10.3 Europe -

Macroeconomic outlook

-

UK: EV infrastructure development

-

Germany: Industry 4.0 and smart manufacturing adoption

-

France: focus on reducing greenhouse gases

-

Italy: energy-efficient buildings as growth opportunity

-

Rest of Europe

10.4 Asia Pacific -

Macroeconomic outlook

-

China: energy conservation and carbon-emissions reduction emphasis

-

Japan: rising need for advanced cooling in healthcare

-

South Korea: thriving electronics & semiconductor industries

-

Rest of Asia Pacific

10.5 Rest of World (RoW) -

Macroeconomic outlook

-

Middle East: economic development and infrastructure expansion

-

South America: rising investment in green technologies

-

Africa: growing awareness of environmental impact of traditional cooling methods

-

Competitive Landscape

11.1 Introduction

11.2 Key Player Strategies / “Right to Win” (Jan 2020–Apr 2025)

11.3 Revenue Analysis (2020–2024)

11.4 Market Share Analysis (2024)

-

Key players in the solid-state cooling market (2024)

11.5 Company Valuation and Financial Metrics

11.6 Brand/Product Comparison

11.7 Company Evaluation Matrix: Key Players (2024) -

Stars

-

Emerging leaders

-

Pervasive players

-

Participants

-

Company footprint (overall, product, technology, vertical, region)

11.8 Company Evaluation Matrix: Startups/SMEs (2024) -

Progressive companies

-

Responsive companies

-

Dynamic companies

-

Starting blocks

-

Competitive benchmarking and lists

-

Company footprint (overall, product, technology, vertical, region)

11.9 Competitive Scenarios -

Product/service launches

-

Deals

-

Expansions

-

Company Profiles

12.1 Key Players

-

Coherent Corp. (business overview; offerings; recent developments; analyst view)

-

Delta Electronics, Inc.

-

Ferrotec Holdings Corporation

-

Tark Thermal Solutions

-

Komatsu Ltd.

-

Crystal Ltd.

-

Same Sky

-

Solid State Cooling Systems, Inc.

-

TE Technology, Inc.

-

TEC Microsystems GmbH

12.2 Other Players -

Align Sourcing LLC

-

AMS Technologies AG

-

Everredtronics

-

Xiamen Hicool Electronics Co., Ltd.

-

INHECO Industrial Heating & Cooling GmbH

-

Kryotherm

-

Merit Technology Group

-

Phononic

-

Sheetak Inc.

-

Thermonamic Electronics (Jiangxi) Corp., Ltd.

-

Wellen Technology Co., Ltd.

-

European Thermodynamics Ltd.

-

Thermoelectric Cooling America Corporation

-

Meerstetter Engineering

-

Custom Thermoelectric, LLC

-

Appendix

13.1 Discussion Guide

13.2 Knowledgestore: MarketsandMarkets’ Subscription Portal

13.3 Customization Options

13.4 Related Reports

13.5 Author Details

Tables List

Table 1 Risk Factor Analysis

Table 2 Average Selling Price Of Chillers, By Key Player, 2024 (Usd)

Table 3 Average Selling Price Trend Of Chillers, By Region (Usd)

Table 4 Role Of Participants In Solid State Cooling Ecosystem

Table 5 List Of Key Patents In Solid State Cooling Market, 2020–2024

Table 6 Import Data For Hs Code 8418-compliant Products, By Country,

2020–2024 (Usd Million)

Table 7 Export Data For Hs Code 8418-compliant Products, By Country,

2020–2024 (Usd Million)

Table 8 List Of Conferences And Events, 2025–2026

Table 9 North America: List Of Regulatory Bodies, Government Agencies, And Other Organizations

Table 10 Europe: List Of Regulatory Bodies, Government Agencies, And Other Organizations

Table 11 Asia Pacific: List Of Regulatory Bodies, Government Agencies, And Other Organizations

Table 12 Row: List Of Regulatory Bodies, Government Agencies, And Other Organizations

Table 13 Impact Of Porter’s Five Forces On Solid State Cooling Market

Table 14 Influence Of Key Stakeholders On Buying Process For Top Three Verticals (%)

Table 15 Key Buying Criteria For Top Three Verticals

Table 16 Us-adjusted Reciprocal Tariff Rates

Table 17 Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 18 Solid State Cooling Market, By Product, 2025–2030 (Usd Million)

Table 19 Refrigeration Systems: Solid State Cooling Market, By Type,

2021–2024 (Usd Million)

Table 20 Refrigeration Systems: Solid State Cooling Market, By Type,

2025–2030 (Usd Million)

Table 21 Refrigeration Systems: Solid State Cooling Market, By Region,

2021–2024 (Usd Million)

Table 22 Refrigeration Systems: Solid State Cooling Market, By Region,

2025–2030 (Usd Million)

Table 23 Refrigeration Systems: Solid State Cooling Market In North America, By Country, 2021–2024 (Usd Million)

Table 24 Refrigeration Systems: Solid State Cooling Market In North America, By Country, 2025–2030 (Usd Million)

Table 25 Refrigeration Systems: Solid State Cooling Market In Europe,

By Country, 2021–2024 (Usd Million)

Table 26 Refrigeration Systems: Solid State Cooling Market In Europe,

By Country, 2025–2030 (Usd Million)

Table 27 Refrigeration Systems: Solid State Cooling Market In Asia Pacific,

By Country, 2021–2024 (Usd Million)

Table 28 Refrigeration Systems: Solid State Cooling Market In Asia Pacific,

By Country, 2025–2030 (Usd Million)

Table 29 Refrigeration Systems: Solid State Cooling Market In Row, By Region, 2021–2024 (Usd Million)

Table 30 Refrigeration Systems: Solid State Cooling Market In Row, By Region, 2025–2030 (Usd Million)

Table 31 Cooling Systems: Solid State Cooling Market, By Type,

2021–2024 (Usd Million)

Table 32 Cooling Systems: Solid State Cooling Market, By Type,

2025–2030 (Usd Million)

Table 33 Cooling Systems: Solid State Cooling Market, By Type,

2021–2024 (Million Units)

Table 34 Cooling Systems: Solid State Cooling Market, By Type,

2025–2030 (Million Units)

Table 35 Cooling Systems: Solid State Cooling Market, By Region,

2021–2024 (Usd Million)

Table 36 Cooling Systems: Solid State Cooling Market, By Region,

2025–2030 (Usd Million)

Table 37 Cooling Systems: Solid State Cooling Market In North America,

By Country, 2021–2024 (Usd Million)

Table 38 Cooling Systems: Solid State Cooling Market In North America,

By Country, 2025–2030 (Usd Million)

Table 39 Cooling Systems: Solid State Cooling Market In Europe, By Country, 2021–2024 (Usd Million)

Table 40 Cooling Systems: Solid State Cooling Market In Europe, By Country, 2025–2030 (Usd Million)

Table 41 Cooling Systems: Solid State Cooling Market In Asia Pacific,

By Country, 2021–2024 (Usd Million)

Table 42 Cooling Systems: Solid State Cooling Market In Asia Pacific,

By Country, 2025–2030 (Usd Million)

Table 43 Cooling Systems: Solid State Cooling Market In Row, By Region,

2021–2024 (Usd Million)

Table 44 Cooling Systems: Solid State Cooling Market In Row, By Region,

2025–2030 (Usd Million)

Table 45 Solid State Cooling Market, By Technology, 2021–2024 (Usd Million)

Table 46 Solid State Cooling Market, By Technology, 2025–2030 (Usd Million)

Table 47 Comparative Study Of Different Solid State Cooling Technologies

And Their Potential

Table 48 Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 49 Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 50 Automotive: Solid State Cooling Market, By Region,

2021–2024 (Usd Million)

Table 51 Automotive: Solid State Cooling Market, By Region,

2025–2030 (Usd Million)

Table 52 Consumer Electronics & Semiconductor: Solid State Cooling Market, By Region, 2021–2024 (Usd Million)

Table 53 Consumer Electronics & Semiconductor: Solid State Cooling Market, By Region, 2025–2030 (Usd Million)

Table 54 Healthcare: Solid State Cooling Market, By Region,

2021–2024 (Usd Million)

Table 55 Healthcare: Solid State Cooling Market, By Region,

2025–2030 (Usd Million)

Table 56 Other Verticals: Solid State Cooling Market, By Region,

2021–2024 (Usd Million)

Table 57 Other Verticals: Solid State Cooling Market, By Region,

2025–2030 (Usd Million)

Table 58 Solid State Cooling Market, By Region, 2021–2024 (Usd Million)

Table 59 Solid State Cooling Market, By Region, 2025–2030 (Usd Million)

Table 60 North America: Solid State Cooling Market, By Country,

2021–2024 (Usd Million)

Table 61 North America: Solid State Cooling Market, By Country,

2025–2030(Usd Million)

Table 62 North America: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 63 North America: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 64 North America: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 65 North America: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 66 Us: Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 67 Us: Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 68 Us: Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 69 Us: Solid State Cooling Market, By Product, 2025–2030 (Usd Million)

Table 70 Canada: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 71 Canada: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 72 Canada: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 73 Canada: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 74 Mexico: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 75 Mexico: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 76 Mexico: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 77 Mexico: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 78 Europe: Solid State Cooling Market, By Country,

2021–2024 (Usd Million)

Table 79 Europe: Solid State Cooling Market, By Country,

2025–2030 (Usd Million)

Table 80 Europe: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 81 Europe: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 82 Europe: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 83 Europe: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 84 Uk: Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 85 Uk: Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 86 Uk: Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 87 Uk: Solid State Cooling Market, By Product, 2025–2030(Usd Million)

Table 88 Germany: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 89 Germany: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 90 Germany: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 91 Germany: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 92 France: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 93 France: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 94 France: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 95 France: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 96 Italy: Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 97 Italy: Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 98 Italy: Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 99 Italy: Solid State Cooling Market, By Product, 2025–2030(Usd Million)

Table 100 Rest Of Europe: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 101 Rest Of Europe: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 102 Rest Of Europe: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 103 Rest Of Europe: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 104 Asia Pacific: Solid State Cooling Market, By Country,

2021–2024 (Usd Million)

Table 105 Asia Pacific: Solid State Cooling Market, By Country,

2025–2030(Usd Million)

Table 106 Asia Pacific: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 107 Asia Pacific: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 108 Asia Pacific: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 109 Asia Pacific: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 110 China: Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 111 China: Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 112 China: Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 113 China: Solid State Cooling Market, By Product, 2025–2030(Usd Million)

Table 114 Japan: Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 115 Japan: Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 116 Japan: Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 117 Japan: Solid State Cooling Market, By Product, 2025–2030(Usd Million)

Table 118 South Korea: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 119 South Korea: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 120 South Korea: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 121 South Korea: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 122 Rest Of Asia Pacific: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 123 Rest Of Asia Pacific: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 124 Rest Of Asia Pacific: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 125 Rest Of Asia Pacific: Solid State Cooling Market, By Product,

2025–2030 (Usd Million)

Table 126 Row: Solid State Cooling Market, By Region, 2021–2024 (Usd Million)

Table 127 Row: Solid State Cooling Market, By Region, 2025–2030(Usd Million)

Table 128 Row: Solid State Cooling Market, By Vertical, 2021–2024 (Usd Million)

Table 129 Row: Solid State Cooling Market, By Vertical, 2025–2030 (Usd Million)

Table 130 Row: Solid State Cooling Market, By Product, 2021–2024 (Usd Million)

Table 131 Row: Solid State Cooling Market, By Product, 2025–2030(Usd Million)

Table 132 Middle East: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 133 Middle East: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 134 Middle East: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 135 Middle East: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 136 South America: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 137 South America: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 138 South America: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 139 South America: Solid State Cooling Market, By Product,

2025–2030(Usd Million)

Table 140 Africa: Solid State Cooling Market, By Vertical,

2021–2024 (Usd Million)

Table 141 Africa: Solid State Cooling Market, By Vertical,

2025–2030 (Usd Million)

Table 142 Africa: Solid State Cooling Market, By Product,

2021–2024 (Usd Million)

Table 143 Africa: Solid State Cooling Market, By Product, 2025–2030(Usd Million)

Table 144 Overview Of Strategies Adopted By Players In

Solid State Cooling Market

Table 145 Degree Of Competition

Table 146 Solid State Cooling Market: Product Footprint

Table 147 Solid State Cooling Market: Technology Footprint

Table 148 Solid State Cooling Market: Vertical Footprint

Table 149 Solid State Cooling Market: Region Footprint

Table 150 Solid State Cooling Market: List Of Startups/Smes

Table 151 Solid State Cooling Market: Product Footprint

Table 152 Solid State Cooling Market: Technology Footprint

Table 153 Solid State Cooling Market: Vertical Footprint

Table 154 Solid State Cooling Market: Region Footprint

Table 155 Solid State Cooling Market: Product/Service Launches,

January 2020–april 2025

Table 156 Solid State Cooling Market: Deals, January 2020–april 2025

Table 157 Solid State Cooling: Expansions, January 2020–april 2025

Table 158 Coherent Corp.: Company Overview

Table 159 Coherent Corp.: Products/Solutions/Services Offered

Table 160 Coherent Corp.: Product/Service Launches

Table 161 Coherent Corp.: Deals

Table 162 Delta Electronics, Inc.: Company Overview

Table 163 Delta Electronics, Inc.: Products/Solutions/Services Offered

Table 164 Delta Electronics, Inc.: Product/Service Launches

Table 165 Ferrotec Holdings Corporation: Company Overview

Table 166 Ferrotec Holdings Corporation:

Products/Solutions/Services Offered

Table 167 Ferrotec Holdings Corporation: Deals

Table 168 Ferrotec Holdings Corporation: Expansions

Table 169 Tark Thermal Solutions: Company Overview

Table 170 Tark Thermal Solutions: Products/Solutions/Services Offered

Table 171 Tark Thermal Solutions: Product/Service Launches

Table 172 Tark Thermal Solutions: Deals

Table 173 Komatsu: Company Overview

Table 174 Komatsu: Products/Solutions/Services Offered

Table 175 Crystal Ltd.: Company Overview

Table 176 Crystal Ltd.: Products/Solutions/Services Offered

Table 177 Same Sky: Company Overview

Table 178 Same Sky: Products/Solutions/Services Offered

Table 179 Same Sky: Product/Service Launches

Table 180 Same Sky: Deals

Table 181 Solid State Cooling Systems: Company Overview

Table 182 Solid State Cooling Systems: Products/Solutions/Services Offered

Table 183 Solid State Cooling Systems: Product/Service Launches

Table 184 Te Technology, Inc.: Company Overview

Table 185 Te Technology, Inc.: Products/Solutions/Services Offered

Table 186 Tec Microsystems Gmbh: Company Overview

Table 187 Tec Microsystems Gmbh: Products/Solutions/Services Offered

Table 188 Tec Microsystems Gmbh: Product/Service Launches