| 【英語タイトル】Lithium-ion Battery Dispersant Market Forecasts to 2030 - Global Analysis By Product (Polymer Dispersants, Organic Dispersants, Inorganic Dispersants, Surfactant-based Dispersants, Water-based Dispersants, Solvent-based Dispersants and Other Products), Battery Type, Application, End User and By Geography

|

| ・商品コード:SMRC192CF663

・発行会社(調査会社):Stratistics MRC

・発行日:2025年2月

・ページ数:約150

・レポート言語:英語

・レポート形式:PDF

・納品方法:Eメール(受注後2-3営業日)

・調査対象地域:グローバル

・産業分野:化学、材料

|

◆販売価格オプション

(消費税別)

※販売価格オプションの説明

※お支払金額:換算金額(日本円)+消費税

※納期:即日〜2営業日(3日以上かかる場合は別途表記又はご連絡)

※お支払方法:納品日+5日以内に請求書を発行・送付(請求書発行日より2ヶ月以内に銀行振込、振込先:三菱UFJ銀行/H&Iグローバルリサーチ株式会社、支払期限と方法は調整可能)

|

❖ レポートの概要 ❖

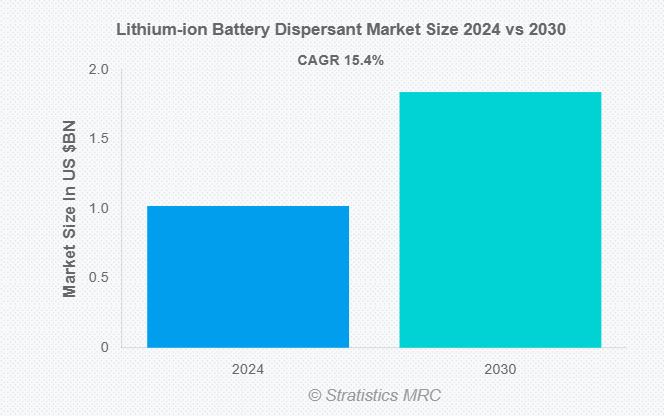

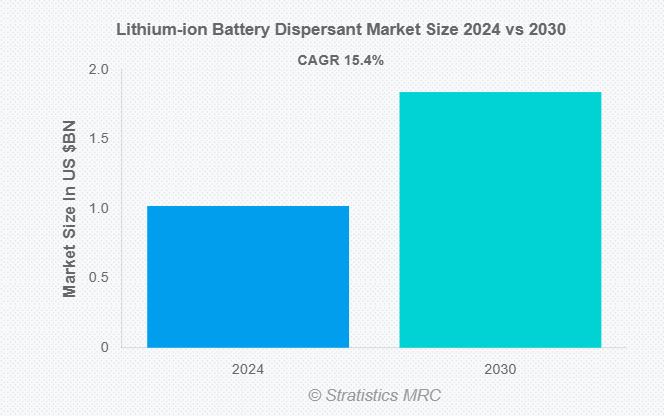

2024年における世界のリチウムイオン電池用分散剤市場は約10.2億ドルと推定され、2030年には18.4億ドルに達すると予測されており、年平均成長率(CAGR)は15.4%です。分散剤は、電極スラリーや電解液における活物質の均一な分散を促進する化学添加剤であり、粒子の凝集を防ぎ、電池性能や安定性、寿命の向上に貢献します。

この市場の主な成長要因は、電気自動車(EV)の需要増加です。分散剤は電極材料の分散性を高め、導電性を向上させて内部抵抗を低減するため、EV向け電池の効率や寿命向上に不可欠です。各国政府と自動車メーカーがEV技術に投資するなかで、エネルギー密度が高く長寿命な電池への需要が分散剤市場の拡大を後押ししています。

一方で、分散剤の一部には生分解性が低く環境負荷の高い成分が含まれており、規制強化や持続可能性に対する懸念から市場成長にブレーキがかかる可能性があります。

今後の成長機会としては、固体電池や高速充電対応電池などの新技術において、均一な分散を実現する高性能分散剤への需要が高まることが挙げられます。また、オンボードセンサーや電極構造に適応する新材料の導入によって、分散剤の重要性がさらに増しています。ただし、さまざまな電池化学に対応しつつ、環境配慮型でかつコストパフォーマンスに優れた製品の開発には技術的な困難も伴います。

COVID-19によって一時的にサプライチェーンが混乱し、生産と原材料調達に影響を及ぼしましたが、パンデミックを通じてEVやエネルギー貯蔵システム、家電製品の需要が回復・拡大し、市場全体は成長軌道に戻りました。

用途別では、電極スラリーの調製工程における分散剤需要が最も高く、粘度制御や均一な材料分布によってコーティング精度とバッテリー性能が向上します。また、家電分野では、分散剤による粒子分離の改善がバッテリーのエネルギー密度や安全性の向上に寄与し、スマートフォンやノートPC、ウェアラブル機器での活用が進んでいます。

地域別では、アジア太平洋が最大市場となっており、中国、日本、韓国の大手電池メーカーが主導する技術革新や製造体制が成長をけん引しています。一方、北米はEVや再生可能エネルギーへの投資増加により最も高い成長率が予測されています。

主要企業にはSolvay、BASF、Kao、Evonik、Clariant、LG化学、ダウ、三菱ケミカル、3M、Daikinなどがあり、2024年にはKaoが高導電性を実現するLUNACREASE™分散剤を発表するなど、新製品の開発も進んでいます。今後もEV普及、エネルギー貯蔵、家電ニーズに対応した分散剤市場の拡大が期待されます。 |

According to Stratistics MRC, the Global Lithium-ion Battery Dispersant Market is accounted for $1.02 billion in 2024 and is expected to reach $1.84 billion by 2030 growing at a CAGR of 15.4% during the forecast period. A lithium-ion battery dispersant is a chemical additive used in the manufacturing process of lithium-ion batteries to enhance the dispersion of active materials in the electrolyte or electrode slurries. It helps prevent the agglomeration of particles, ensuring uniform distribution of components, which improves the overall performance, stability, and life cycle of the battery. By maintaining consistent particle size and preventing settling, they contribute to enhanced battery efficiency and reliability.

According to the American Chemistry Council (ACC), in the United States, solvent-based coatings are widely used for industrial coatings, which account for approximately 65%.

Market Dynamics:

Driver:

Rising demand for electric vehicles (EVs)

As the adoption of EVs accelerates, the need for efficient, high-performance lithium-ion batteries becomes crucial. Dispersants play a vital role in enhancing the dispersion of active materials in battery electrodes, optimizing conductivity, and reducing internal resistance. This improves battery efficiency, lifespan, and overall performance, which are essential for EV applications. With governments and automakers investing in EV technology, the increasing demand for energy-dense, long-lasting batteries directly boosts the need for specialized dispersants, driving market expansion in this sector.

Restraint:

Environmental impact of dispersants

The environmental impact of dispersants arises from concerns about the potential toxicity and non-biodegradability of certain chemical compounds used in their formulation. Some dispersants may release harmful substances into ecosystems during production or disposal, raising concerns about their long-term environmental effects. This can lead to stricter regulatory scrutiny and higher compliance costs for manufacturers. As sustainability becomes a priority across industries, the adoption of harmful dispersants may be limited, hindering market growth.

Opportunity:

Technological advancements in battery chemistry

As battery performance improves with new materials and chemistries, the need for dispersants becomes essential to ensure uniform distribution of active materials, enhance energy density, and improve stability. Dispersants help prevent agglomeration of particles, optimizing the battery’s performance and lifespan. With innovations like solid-state batteries, higher charging speeds, and longer-lasting power sources, the demand for specialized dispersants increases, driving their adoption across electric vehicles, renewable energy storage, and consumer electronics, further fueling market expansion.

Threat:

Technical challenges in product development

Technical challenges in product development arise from the complexity of creating dispersants that effectively improve battery performance while meeting environmental and sustainability standards. Developing dispersants that can work with various battery chemistries, enhance energy efficiency, and maintain stability over time requires extensive research and innovation. The difficulty in formulating dispersants that balance performance and cost hampers market growth.

Covid-19 Impact

The covid-19 pandemic disrupted the lithium-ion battery dispersant market by causing supply chain delays, reduced manufacturing capacity, and workforce shortages. These challenges led to a temporary slowdown in production and the procurement of raw materials. However, the increasing demand for electric vehicles, energy storage solutions, and consumer electronics during the pandemic accelerated the market’s recovery. The shift towards cleaner energy solutions and growing adoption of electric mobility also fostered long-term growth for the lithium-ion battery dispersant market post-pandemic.

The slurry preparation segment is expected to be the largest during the forecast period

The slurry preparation segment is predicted to secure the largest market share throughout the forecast period. Lithium-ion battery dispersants are essential in slurry preparation for battery electrode fabrication. These dispersants improve the uniformity of the slurry by preventing particles from agglomerating, ensuring an even distribution of active materials, binders, and solvents. They help achieve optimal viscosity, enhancing the coating process on current collectors. This results in higher performance and longer lifespan of the battery.

The consumer electronics segment is expected to have the highest CAGR during the forecast period

The consumer electronics segment is anticipated to witness the highest CAGR during the forecast period owing to its optimal performance and stability. These additives prevent the aggregation of particles in the battery slurry, improving the uniformity of electrode materials. In applications like smart phones, laptops, and wearable devices, dispersants enhance the battery’s energy density, charge cycles, and overall lifespan. By maintaining consistent dispersion, these additives help improve the efficiency and safety of lithium-ion batteries, making them essential for high-performance consumer electronic products.

Region with largest share:

Asia Pacific is expected to register the largest market share during the forecast period driven by the growing demand for electric vehicles (EVs), renewable energy storage, and consumer electronics. Countries like China, Japan, and South Korea dominate the market, supported by large-scale battery manufacturing and technological advancements. Additionally, the region’s established supply chain infrastructure and significant investment in R&D contribute to the market’s robust growth in the Asia-Pacific region.

Region with highest CAGR:

North America is expected to witness the highest CAGR over the forecast period fuelled by the rising demand for electric vehicles (EVs), energy storage systems, and portable electronics. The U.S. and Canada are key contributors, with major advancements in EV adoption, renewable energy integration, and battery manufacturing. Government initiatives, such as subsidies and green energy policies, are further positioning North America as a critical region in the global lithium-ion battery dispersant market.

Key players in the market

Some of the key players profiled in the Lithium-ion Battery Dispersant Market include Solvay, BASF SE, Croda International Plc, Dow Inc., Evonik Industries AG, Clariant AG, Arkema S.A., Imerys S.A., Kao Corporation, Honeywell International Inc., Mitsubishi Chemical Corporation, LG Chem, Daikin Industries Limited, 3M Company, Ashland Global Holdings Inc., Wacker Chemie AG, Cabot Corporation, BYK-Chemie GmbH, The Lubrizol Corporation and Orion Engineered Carbons.

Key Developments:

In April 2024, Kao Corporation developed the LUNACREASE™ dispersant, which efficiently disperses conductive carbon used in lithium-ion battery electrodes. This innovation promotes the formation of a conductive network within the electrode, resulting in lower resistance and improved battery capacity and output.

In May 2023, BASF announced a significant investment in the production of water-based anode binders, aimed at supporting the growing demand for the lithium-ion battery industry. The company’s move comes in response to the rapid development of electric vehicles (EVs), renewable energy systems, and the increasing need for high-performance energy storage solutions.

Products Covered:

• Polymer Dispersants

• Organic Dispersants

• Inorganic Dispersants

• Surfactant-based Dispersants

• Water-based Dispersants

• Solvent-based Dispersants

• Other Products

Battery Types Covered:

• Lithium-Iron-Phosphate (LiFePO4)

• Lithium-Titanate Oxide (LTO)

• Lithium-Cobalt Oxide (LiCoO2)

• Lithium-Nickel-Manganese-Cobalt Oxide (Li-NMC)

• Lithium-Nickel-Cobalt-Aluminum Oxide (NCA)

• Other Battery Types

Applications Covered:

• Separators

• Electrolytes

• Binder Systems

• Slurry Preparation

• Cathode Materials

• Anode Materials

• Other Applications

End Users Covered:

• Automotive

• Consumer Electronics

• Energy Storage Systems

• Industrial

• Aerospace & Defense

• Other End Users

Regions Covered:

• North America

o US

o Canada

o Mexico

• Europe

o Germany

o UK

o Italy

o France

o Spain

o Rest of Europe

• Asia Pacific

o Japan

o China

o India

o Australia

o New Zealand

o South Korea

o Rest of Asia Pacific

• South America

o Argentina

o Brazil

o Chile

o Rest of South America

• Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Rest of Middle East & Africa

1 Executive Summary

2 Preface

2.1 Abstract

2.2 Stake Holders

2.3 Research Scope

2.4 Research Methodology

2.4.1 Data Mining

2.4.2 Data Analysis

2.4.3 Data Validation

2.4.4 Research Approach

2.5 Research Sources

2.5.1 Primary Research Sources

2.5.2 Secondary Research Sources

2.5.3 Assumptions

3 Market Trend Analysis

3.1 Introduction

3.2 Drivers

3.3 Restraints

3.4 Opportunities

3.5 Threats

3.6 Product Analysis

3.7 Application Analysis

3.8 End User Analysis

3.9 Emerging Markets

3.10 Impact of Covid-19

4 Porters Five Force Analysis

4.1 Bargaining power of suppliers

4.2 Bargaining power of buyers

4.3 Threat of substitutes

4.4 Threat of new entrants

4.5 Competitive rivalry

5 Global Lithium-ion Battery Dispersant Market, By Product

5.1 Introduction

5.2 Polymer Dispersants

5.2.1 Polyvinylidene Fluoride (PVDF) Dispersants

5.2.2 Acrylic Polymer Dispersants

5.2.3 Carboxylic Acid Polymer Dispersants

5.3 Organic Dispersants

5.4.1 Polyethylene Glycol (PEG) Dispersants

5.4.2 Polypropylene Glycol (PPG) Dispersants

5.4.3 Alkylamine-based Dispersants

5.4 Inorganic Dispersants

5.5.1 Carbon-based Dispersants

5.5.2 Silica-based Dispersants

5.5 Surfactant-based Dispersants

5.6 Water-based Dispersants

5.7 Solvent-based Dispersants

5.8 Other Products

6 Global Lithium-ion Battery Dispersant Market, By Battery Type

6.1 Introduction

6.2 Lithium-Iron-Phosphate (LiFePO4)

6.3 Lithium-Titanate Oxide (LTO)

6.4 Lithium-Cobalt Oxide (LiCoO2)

6.5 Lithium-Nickel-Manganese-Cobalt Oxide (Li-NMC)

6.6 Lithium-Nickel-Cobalt-Aluminum Oxide (NCA)

6.7 Other Battery Types

7 Global Lithium-ion Battery Dispersant Market, By Application

7.1 Introduction

7.2 Separators

7.3 Electrolytes

7.4 Binder Systems

7.5 Slurry Preparation

7.6 Cathode Materials

7.7 Anode Materials

7.8 Other Applications

8 Global Lithium-ion Battery Dispersant Market, By End User

8.1 Introduction

8.2 Automotive

8.3 Consumer Electronics

8.4 Energy Storage Systems

8.5 Industrial

8.6 Aerospace & Defense

8.7 Other End Users

9 Global Lithium-ion Battery Dispersant Market, By Geography

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 Italy

9.3.4 France

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Australia

9.4.5 New Zealand

9.4.6 South Korea

9.4.7 Rest of Asia Pacific

9.5 South America

9.5.1 Argentina

9.5.2 Brazil

9.5.3 Chile

9.5.4 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Qatar

9.6.4 South Africa

9.6.5 Rest of Middle East & Africa

10 Key Developments

10.1 Agreements, Partnerships, Collaborations and Joint Ventures

10.2 Acquisitions & Mergers

10.3 New Product Launch

10.4 Expansions

10.5 Other Key Strategies

11 Company Profiling

11.1 Solvay

11.2 BASF SE

11.3 Croda International Plc

11.4 Dow Inc.

11.5 Evonik Industries AG

11.6 Clariant AG

11.7 Arkema S.A.

11.8 Imerys S.A.

11.9 Kao Corporation

11.10 Honeywell International Inc.

11.11 Mitsubishi Chemical Corporation

11.12 LG Chem

11.13 Daikin Industries Limited

11.14 3M Company

11.15 Ashland Global Holdings Inc.

11.16 Wacker Chemie AG

11.17 Cabot Corporation

11.18 BYK-Chemie GmbH

11.19 The Lubrizol Corporation

11.20 Orion Engineered Carbons

List of Tables

1 Global Lithium-ion Battery Dispersant Market Outlook, By Region (2022-2030) ($MN)

2 Global Lithium-ion Battery Dispersant Market Outlook, By Product (2022-2030) ($MN)

3 Global Lithium-ion Battery Dispersant Market Outlook, By Polymer Dispersants (2022-2030) ($MN)

4 Global Lithium-ion Battery Dispersant Market Outlook, By Polyvinylidene Fluoride (PVDF) Dispersants (2022-2030) ($MN)

5 Global Lithium-ion Battery Dispersant Market Outlook, By Acrylic Polymer Dispersants (2022-2030) ($MN)

6 Global Lithium-ion Battery Dispersant Market Outlook, By Carboxylic Acid Polymer Dispersants (2022-2030) ($MN)

7 Global Lithium-ion Battery Dispersant Market Outlook, By Organic Dispersants (2022-2030) ($MN)

8 Global Lithium-ion Battery Dispersant Market Outlook, By Polyethylene Glycol (PEG) Dispersants (2022-2030) ($MN)

9 Global Lithium-ion Battery Dispersant Market Outlook, By Polypropylene Glycol (PPG) Dispersants (2022-2030) ($MN)

10 Global Lithium-ion Battery Dispersant Market Outlook, By Alkylamine-based Dispersants (2022-2030) ($MN)

11 Global Lithium-ion Battery Dispersant Market Outlook, By Inorganic Dispersants (2022-2030) ($MN)

12 Global Lithium-ion Battery Dispersant Market Outlook, By Carbon-based Dispersants (2022-2030) ($MN)

13 Global Lithium-ion Battery Dispersant Market Outlook, By Silica-based Dispersants (2022-2030) ($MN)

14 Global Lithium-ion Battery Dispersant Market Outlook, By Surfactant-based Dispersants (2022-2030) ($MN)

15 Global Lithium-ion Battery Dispersant Market Outlook, By Water-based Dispersants (2022-2030) ($MN)

16 Global Lithium-ion Battery Dispersant Market Outlook, By Solvent-based Dispersants (2022-2030) ($MN)

17 Global Lithium-ion Battery Dispersant Market Outlook, By Other Products (2022-2030) ($MN)

18 Global Lithium-ion Battery Dispersant Market Outlook, By Battery Type (2022-2030) ($MN)

19 Global Lithium-ion Battery Dispersant Market Outlook, By Lithium-Iron-Phosphate (LiFePO4) (2022-2030) ($MN)

20 Global Lithium-ion Battery Dispersant Market Outlook, By Lithium-Titanate Oxide (LTO) (2022-2030) ($MN)

21 Global Lithium-ion Battery Dispersant Market Outlook, By Lithium-Cobalt Oxide (LiCoO2) (2022-2030) ($MN)

22 Global Lithium-ion Battery Dispersant Market Outlook, By Lithium-Nickel-Manganese-Cobalt Oxide (Li-NMC) (2022-2030) ($MN)

23 Global Lithium-ion Battery Dispersant Market Outlook, By Lithium-Nickel-Cobalt-Aluminum Oxide (NCA) (2022-2030) ($MN)

24 Global Lithium-ion Battery Dispersant Market Outlook, By Other Battery Types (2022-2030) ($MN)

25 Global Lithium-ion Battery Dispersant Market Outlook, By Application (2022-2030) ($MN)

26 Global Lithium-ion Battery Dispersant Market Outlook, By Separators (2022-2030) ($MN)

27 Global Lithium-ion Battery Dispersant Market Outlook, By Electrolytes (2022-2030) ($MN)

28 Global Lithium-ion Battery Dispersant Market Outlook, By Binder Systems (2022-2030) ($MN)

29 Global Lithium-ion Battery Dispersant Market Outlook, By Slurry Preparation (2022-2030) ($MN)

30 Global Lithium-ion Battery Dispersant Market Outlook, By Cathode Materials (2022-2030) ($MN)

31 Global Lithium-ion Battery Dispersant Market Outlook, By Anode Materials (2022-2030) ($MN)

32 Global Lithium-ion Battery Dispersant Market Outlook, By Other Applications (2022-2030) ($MN)

33 Global Lithium-ion Battery Dispersant Market Outlook, By End User (2022-2030) ($MN)

34 Global Lithium-ion Battery Dispersant Market Outlook, By Automotive (2022-2030) ($MN)

35 Global Lithium-ion Battery Dispersant Market Outlook, By Consumer Electronics (2022-2030) ($MN)

36 Global Lithium-ion Battery Dispersant Market Outlook, By Energy Storage Systems (2022-2030) ($MN)

37 Global Lithium-ion Battery Dispersant Market Outlook, By Industrial (2022-2030) ($MN)

38 Global Lithium-ion Battery Dispersant Market Outlook, By Aerospace & Defense (2022-2030) ($MN)

39 Global Lithium-ion Battery Dispersant Market Outlook, By Other End Users (2022-2030) ($MN)