https://www.marketsandmarkets.com/Market-Reports/business-process-as-a-service-bpaas-market-986.html

- 5.1 INTRODUCTION

-

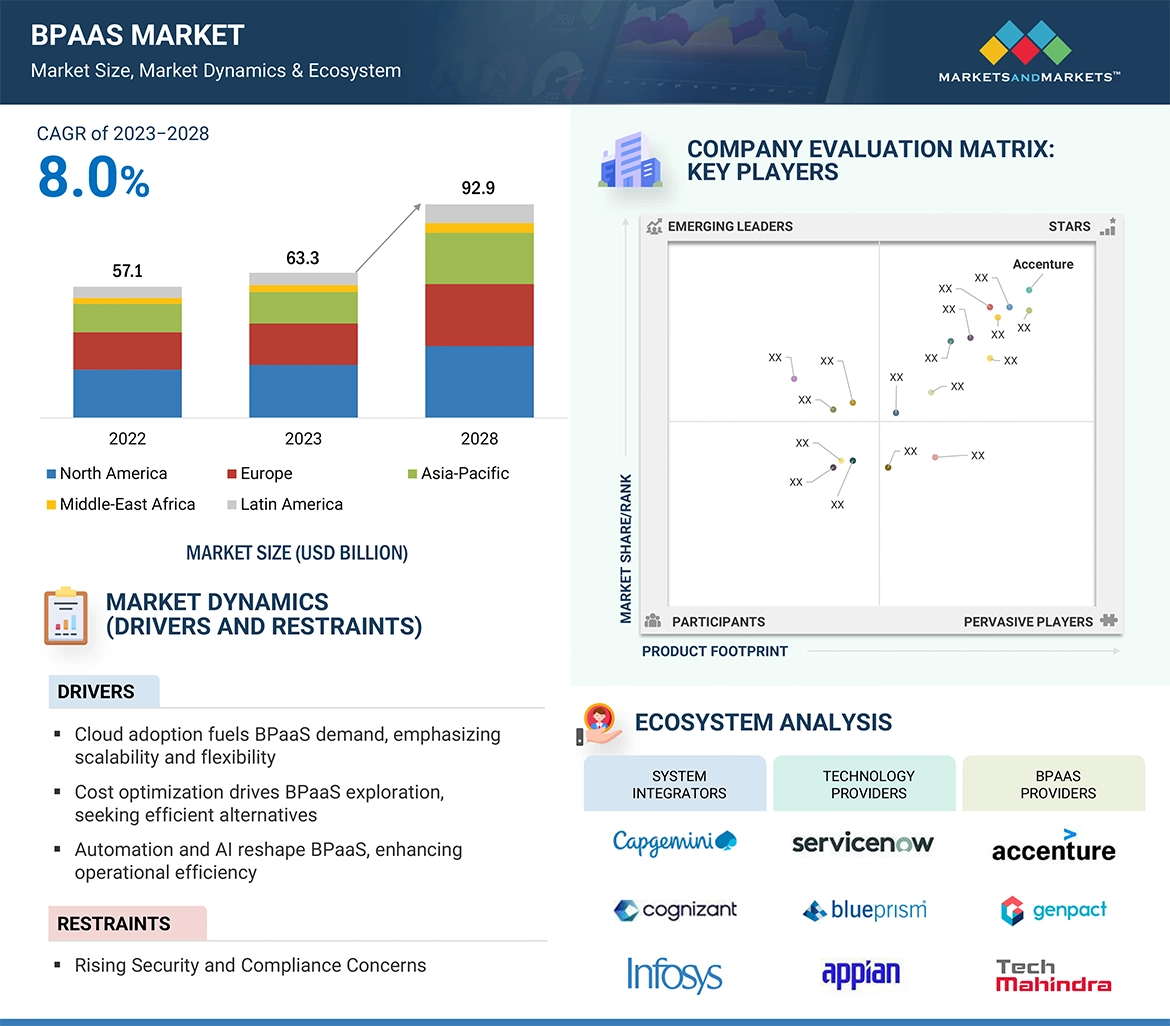

5.2 MARKET DYNAMICSDRIVERS– Cloud adoption emphasized scalability and flexibility– Cost optimization to drive need for efficient alternatives– Automation and AI enhance operational efficiency of BPaaS– Surge in industry-specific BPaaS solutions, fostering innovation and customization– Growth of BPaaS adoption among SMEs, enhancing accessibility and competitivenessRESTRAINTS– Rise in security and compliance concerns– Dependency concerns on specific BPaaS providersOPPORTUNITIES– Focus on multi-process business workflow– Expanding market access and inclusivity in BPaaS solutionsCHALLENGES– Challenges integrating BPaaS with existing systems– Navigating evolving regulations hampers growth and innovation

-

5.3 CASE STUDY ANALYSISACCENTURE’S SYNOPS FUELED OPERATIONAL EXCELLENCE FOR LEADING OIL & GAS COMPANYCOGNIZANT BPAAS DROVE HEALTH PLAN TO EFFICIENCY AND REVENUE LEADERSHIPINFOSYS BPM SCALED TECH LEADER’S NLP WITH IMPROVED EFFICIENCY AND SIGNIFICANT CONFLICT REDUCTIONGENPACT’S OPERATIONAL RESILIENCE FRAMEWORK ENABLED LEADING FINANCIAL ORGANIZATION TO ANTICIPATE AND ADAPTTCS SUPPORTED OPERATIONAL EXCELLENCE THROUGH COST REDUCTION AND RISK MITIGATION FOR LARGE GLOBAL INVESTMENT BANK

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM

-

5.6 TECHNOLOGICAL ANALYSISKEY TECHNOLOGIES– Cloud computing– Data analyticsCOMPLEMENTARY TECHNOLOGIES– Internet of things (IoT)– AR/VR– 5GADJACENT TECHNOLOGIES– Blockchain– AI/ML

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY SERVICE

- 5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 BUSINESS MODEL ANALYSIS

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 KEY CONFERENCES AND EVENTS

-

6.1 INTRODUCTIONBUSINESS PROCESS: BPAAS MARKET DRIVERS

-

6.2 HUMAN RESOURCE MANAGEMENTOPTIMIZING RESOURCE UTILIZATION, IMPROVING OPERATIONAL EFFICIENCY, AND FOCUSING ON STRATEGIC INITIATIVESPAYROLL PROCESSINGEMPLOYEE ONBOARDINGBENEFITS ADMINISTRATIONOTHER HUMAN RESOURCE MANAGEMENT PROCESSES

-

6.3 ACCOUNTING & FINANCENEED TO MITIGATE RISKS ASSOCIATED WITH FINANCIAL TRANSACTIONSACCOUNTS PAYABLEGENERAL LEDGERFINANCIAL REPORTINGOTHER ACCOUNTING & FINANCE PROCESSES

-

6.4 SALES & MARKETINGNEED FOR LEAD SCORING, CUSTOMER SEGMENTATION, EMAIL MARKETING, AND SOCIAL MEDIA MANAGEMENTLEAD GENERATION SERVICESCUSTOMER RELATIONSHIP MANAGEMENT (CRM) SERVICESOTHER SALES & MARKETING PROCESSES

-

6.5 CUSTOMER SERVICE & SUPPORTGROWTH IN AWARENESS REGARDING CUSTOMER SATISFACTION AND LOYALTY IN COMPETITIVE MARKETSCALL CENTER OPERATIONSHELP DESK SUPPORTTICKET MANAGEMENTOTHER CUSTOMER SERVICE & SUPPORT PROCESSES

-

6.6 PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATIONSSTREAMLINING PROCUREMENT AND SUPPLY CHAINS & OPERATIONS WITH END-TO-END SUPPORTVENDOR MANAGEMENTPURCHASE ORDER PROCESSINGINVENTORY OPTIMIZATIONDISTRIBUTION & LOGISTICSOTHER PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATION PROCESSES

- 6.7 OTHER BUSINESS PROCESSES

-

7.1 INTRODUCTIONDEPLOYMENT MODEL: BPAAS MARKET DRIVERS

-

7.2 PUBLIC CLOUDSCALABILITY, FLEXIBILITY, AND COST-EFFICIENCY SOUGHT BY ORGANIZATIONS

-

7.3 PRIVATE CLOUDMEETING SPECIFIC WORKLOAD REQUIREMENTS TO ENSURE OPTIMAL PERFORMANCE AND USER SATISFACTION

-

7.4 HYBRID CLOUDINTEROPERABILITY BETWEEN ON-PREMISES SYSTEMS AND CLOUD SERVICES TO OFFER ADDED LEVERAGE IN USING NEWER TECHNOLOGIES

-

8.1 INTRODUCTIONORGANIZATION SIZE: BPAAS MARKET DRIVERS

-

8.2 LARGE ENTERPRISESBUSINESS PROCESS SERVICES TAILORED TO NEEDS OF LARGE ENTERPRISES

-

8.3 SMALL & MEDIUM-SIZED ENTERPRISESECONOMICAL BUSINESS PROCESS SERVICES ALIGNING WITH NEEDS OF SMES

-

9.1 INTRODUCTIONVERTICAL: BPAAS MARKET DRIVERS

-

9.2 BFSIBFSI: USE CASES– Retail banking– Investment bankingOTHER BFSI USE CASES

-

9.3 IT & TELECOMIT & TELECOM: USE CASES– Billing & invoicing– Network management– Other it & telecom use cases

-

9.4 MANUFACTURINGMANUFACTURING: USE CASES– Production planning & controlASSET MANAGEMENTOTHER MANUFACTURING USE CASES

-

9.5 RETAIL & ECOMMERCEUNIFIED SHOPPING EXPERIENCE ACROSS ALL CHANNELSRETAIL & ECOMMERCE: USE CASES– Order processing– Inventory management– Other Retail & eCommerce use cases

-

9.6 HEALTHCARE & LIFE SCIENCESPERSONALIZED TREATMENTS TO FACILITATE BPAAS WITH PRECISE ANALYTICSHEALTHCARE & LIFE SCIENCES: USE CASES– Medical billingCLAIMS PROCESSINGOTHER HEALTHCARE & LIFE SCIENCES USE CASES

-

9.7 GOVERNMENT & PUBLIC SECTORSERVICES FOR PUBLIC WITH ENHANCED FINANCIAL AND SECURITY DRIVEN BY BPAASGOVERNMENT & PUBLIC SECTOR: USE CASES– Regulatory Compliance– Public Finance & Budgeting– Other government & public sector use cases

- 9.8 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: BPAAS MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS– Huge cloud adoption with industry-specific BPaaS offeringsCANADA– Prioritizing AI and RPA integration for enhanced automation and efficiency with high concentration of SMEs

-

10.3 EUROPEEUROPEAN BPAAS MARKET DRIVERSEUROPE: RECESSION IMPACTUK– Growing adoption of advanced technologies to increase demand for BPaaSGERMANY– Rise in emphasis on enhancing customer experience using BPaaS solutionsFRANCE– Rise in adoption of cloud-based BPaaS solutionsITALY– Increase in adoption of BPaaS in SMEsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: BPAAS MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA– Rapid adoption of cloud-based services due to rise in work-from-home operationsJAPAN– Growth in need to standardize or customize servicesAUSTRALIA & NEW ZEALAND– Enhanced efficiency across organizations with BPaaSREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: BPAAS MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGCC– Huge demand for outsourcing critical processes– Saudi Arabia– UAE– Rest of GCCSOUTH AFRICA– Increase in use of cloud services that offer cost optimizationREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: BPAAS MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL– Development of IT industryMEXICO– Higher focus on improving business operations with remote access to skilled professionalsREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 PRODUCT/BRAND COMPARISON

-

11.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT FOR KEY PLAYERS

-

11.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.8 COMPANY FINANCIAL METRICS

-

11.9 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES & PRODUCT ENHANCEMENTSDEALS

-

12.1 KEY PLAYERSACCENTURE– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewCAPGEMINI– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewCOGNIZANT– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewIBM– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewHCL– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewTCS– Business overview– Products/Solutions/Services offered– Recent Developments– MnM ViewFUJITSU– Business overview– Products/Solutions/Services offered– Recent developments– MnM ViewGENPACT– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewWIPRO– Business overview– Products/Solutions/Services offered– Recent developments– MnM viewTECH MAHINDRA– Business overview– Products/Solutions/Services offered– Recent developments– MnM view

-

12.2 OTHER KEY PLAYERSEXLDXC TECHNOLOGYCONDUENTINFOSYS BPMBIZAGIIGRAFXAURAQUANTICPIPEFYCFLOWAGILEPOINTWORKFLOWGENFLOKZUINTEGRIFYLINXQUIXY

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 BPAAS MARKET ECOSYSTEM AND ADJACENT MARKETS

-

13.4 BUSINESS PROCESS AUTOMATION MARKETBUSINESS PROCESS AUTOMATION MARKET, BY COMPONENTBUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE

-

13.5 BUSINESS PROCESS MANAGEMENT MARKETBUSINESS PROCESS MANAGEMENT MARKET, BY COMPONENTBUSINESS PROCESS MANAGEMENT MARKET, BY BUSINESS FUNCTION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 BPAAS MARKET SIZE AND GROWTH, 2018–2022 (USD MILLION AND Y-O-Y)

- TABLE 4 BPAAS MARKET SIZE AND GROWTH, 2023–2028 (USD MILLION AND Y-O-Y)

- TABLE 5 INDICATIVE PRICING ANALYSIS OF BPAAS VENDORS, BY OFFERING

- TABLE 6 US: TOP 10 PATENT APPLICANTS

- TABLE 7 PORTER’S FIVE FORCES IMPACT ON BPAAS MARKET

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 13 KEY BUYING CRITERIA FOR END USERS

- TABLE 14 BPAAS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024

- TABLE 15 MARKET, BY BUSINESS PROCESS, 2018–2022 (USD MILLION)

- TABLE 16 MARKET, BY BUSINESS PROCESS, 2023–2028 (USD MILLION)

- TABLE 17 MARKET IN HUMAN RESOURCE MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 MARKET IN HUMAN RESOURCE MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 MARKET IN ACCOUNTING & FINANCE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 MARKET IN ACCOUNTING & FINANCE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 MARKET IN SALES & MARKETING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 MARKET IN SALES & MARKETING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MARKET IN CUSTOMER SERVICE & SUPPORT, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 MARKET IN CUSTOMER SERVICE & SUPPORT, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET IN PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 MARKET IN PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET IN OTHER BUSINESS PROCESSES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 MARKET IN OTHER BUSINESS PROCESSES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 30 BPAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 31 PUBLIC CLOUD-BASED MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 PUBLIC CLOUD-BASED MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 PRIVATE CLOUD-BASED MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 PRIVATE CLOUD-BASED MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 HYBRID CLOUD-BASED MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 HYBRID CLOUD-BASED MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 38 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 39 MARKET FOR LARGE ENTERPRISES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 MARKET FOR LARGE ENTERPRISES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 44 BPAAS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 45 MARKET IN BFSI VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 MARKET IN BFSI VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MARKET IN IT & TELECOM VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 MARKET IN IT & TELECOM VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 BPAAS MARKET IN MANUFACTURING VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 MARKET IN MANUFACTURING VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 MARKET IN RETAIL & ECOMMERCE VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 MARKET IN RETAIL & ECOMMERCE VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MARKET IN GOVERNMENT & PUBLIC SECTOR VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 MARKET IN GOVERNMENT & PUBLIC SECTOR VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 MARKET IN OTHER VERTICALS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 MARKET IN OTHER VERTICALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 BPAAS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY BUSINESS PROCESS, 2018–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY BUSINESS PROCESS, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: BPAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 US: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 72 US: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 73 US: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 74 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 76 CANADA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY BUSINESS PROCESS, 2018–2022 (USD MILLION)

- TABLE 80 EUROPE: BPAAS MARKET, BY BUSINESS PROCESS, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: BPAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 UK: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 90 UK: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 91 UK: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 92 UK: BPAAS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 93 GERMANY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 94 GERMANY: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 95 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 96 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 97 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 98 FRANCE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 99 FRANCE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 100 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 101 ITALY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 102 ITALY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 103 ITALY: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 104 ITALY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: BPAAS MARKET, BY BUSINESS PROCESS, 2018–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: BPAAS MARKET, BY BUSINESS PROCESS, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: BPAAS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 CHINA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 120 CHINA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 121 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 123 JAPAN: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 124 JAPAN: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 125 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 126 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 129 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 130 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: BPAAS MARKET, BY BUSINESS PROCESS, 2018–2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: BPAAS MARKET, BY BUSINESS PROCESS, 2023–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: BPAAS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY/REGION, 2018–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 145 GCC: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 146 GCC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 147 GCC: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 148 GCC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 149 GCC: BPAAS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 150 GCC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 151 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 152 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 153 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 154 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY BUSINESS PROCESS, 2018–2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: MARKET, BY BUSINESS PROCESS, 2023–2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 162 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 164 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 165 LATIN AMERICA: BPAAS MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 166 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 168 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 169 BRAZIL: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 170 BRAZIL: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 171 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 172 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 173 MEXICO: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 174 MEXICO: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 175 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 176 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 181 OVERVIEW OF STRATEGIES ADOPTED BY KEY BPAAS VENDORS

- TABLE 182 BPAAS MARKET: DEGREE OF COMPETITION

- TABLE 183 VENDOR PRODUCTS/BRANDS COMPARISON

- TABLE 184 REGION FOOTPRINT

- TABLE 185 BUSINESS PROCESS FOOTPRINT

- TABLE 186 DEPLOYMENT MODEL FOOTPRINT

- TABLE 187 ORGANIZATION SIZE FOOTPRINT

- TABLE 188 VERTICAL FOOTPRINT

- TABLE 189 BPAAS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2023

- TABLE 190 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 191 MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, SEPTEMBER 2020–NOVEMBER 2023

- TABLE 192 MARKET: DEALS, FEBRUARY 2023–JANUARY 2024

- TABLE 193 ACCENTURE: BUSINESS OVERVIEW

- TABLE 194 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ACCENTURE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 196 ACCENTURE: DEALS

- TABLE 197 CAPGEMINI: COMPANY OVERVIEW

- TABLE 198 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 CAPGEMINI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 200 CAPGEMINI: DEALS

- TABLE 201 COGNIZANT: BUSINESS OVERVIEW

- TABLE 202 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 COGNIZANT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 204 COGNIZANT DEALS

- TABLE 205 IBM: BUSINESS OVERVIEW

- TABLE 206 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 208 IBM: DEALS

- TABLE 209 HCL: BUSINESS OVERVIEW

- TABLE 210 HCL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 HCL: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 212 HCL: DEALS

- TABLE 213 TCS: COMPANY OVERVIEW

- TABLE 214 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TCS: DEALS

- TABLE 216 FUJITSU: COMPANY OVERVIEW

- TABLE 217 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 FUJITSU: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 219 FUJITSU: DEALS

- TABLE 220 GENPACT: COMPANY OVERVIEW

- TABLE 221 GENPACT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 GENPACT: DEALS

- TABLE 223 WIPRO: COMPANY OVERVIEW

- TABLE 224 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 WIPRO: DEALS

- TABLE 226 TECH MAHINDRA: COMPANY OVERVIEW

- TABLE 227 TECH MAHINDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 TECH MAHINDRA: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 229 TECH MAHINDRA: DEALS

- TABLE 230 ADJACENT MARKETS AND FORECASTS

- TABLE 231 BUSINESS PROCESS AUTOMATION MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

- TABLE 232 BUSINESS PROCESS AUTOMATION MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 233 BUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

- TABLE 234 BUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

- TABLE 235 BUSINESS PROCESS MANAGEMENT MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 236 BUSINESS PROCESS MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

- FIGURE 1 BPAAS MARKET SEGMENTATION

- FIGURE 2 MARKET SEGMENTATION, BY REGION

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKUP OF PRIMARY PROFILES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 6 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET: RESEARCH FLOW

- FIGURE 10 BPAAS MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 11 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 12 CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 13 DEMAND-SIDE APPROACH

- FIGURE 14 MARKET: DATA TRIANGULATION

- FIGURE 15 GLOBAL BPAAS TO WITNESS SIGNIFICANT GROWTH

- FIGURE 16 FASTEST-GROWING SEGMENTS IN MARKET, 2023–2028

- FIGURE 17 MARKET: REGIONAL SNAPSHOT, 2023–2028

- FIGURE 18 STREAMLINING AND OPTIMIZING BUSINESS PROCESSES THROUGH BPAAS TO RESULT IN IMPROVED CUSTOMER EXPERIENCES

- FIGURE 19 HUMAN RESOURCE MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SHARE AMONG BUSINESS PROCESS DURING FORECAST PERIOD

- FIGURE 20 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SHARE AMONG DEPLOYMENT MODELS DURING FORECAST PERIOD

- FIGURE 21 LARGE ENTERPRISES TO ACCOUNT FOR LARGER ADOPTION OF MARKET DURING FORECAST PERIOD

- FIGURE 22 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MARKET: ECOSYSTEM

- FIGURE 27 BPAAS ASP OF KEY PLAYERS, BY SERVICE (USD/MONTH)

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2013–2023

- FIGURE 29 TOP FIVE GLOBAL PATENT OWNERS

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 REVENUE SHIFT FOR MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR END USERS

- FIGURE 34 MARKET: BUSINESS MODEL

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO OF MAJOR BPAAS COMPANIES

- FIGURE 36 HUMAN RESOURCE MANAGEMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 37 HYBRID CLOUD DEPLOYMENT MODEL TO RECORD HIGHEST CAGR

- FIGURE 38 SMALL & MEDIUM-SIZED ENTERPRISES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 RETAIL & ECOMMERCE VERTICAL TO RECORD HIGHER CAGR

- FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN MARKET

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN PAST FIVE YEARS (USD BILLION)

- FIGURE 44 SHARE OF LEADING COMPANIES IN MARKET, 2022

- FIGURE 45 MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 46 COMPANY FOOTPRINT

- FIGURE 47 MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 48 COMPANY FINANCIAL METRICS, 2024

- FIGURE 49 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 50 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 51 COGNIZANT: COMPANY SNAPSHOT

- FIGURE 52 IBM: COMPANY SNAPSHOT

- FIGURE 53 HCL: COMPANY SNAPSHOT

- FIGURE 54 TCS: COMPANY SNAPSHOT

- FIGURE 55 FUJITSU: COMPANY SNAPSHOT

- FIGURE 56 GENPACT: COMPANY SNAPSHOT

- FIGURE 57 WIPRO: COMPANY SNAPSHOT

- FIGURE 58 TECH MAHINDRA: COMPANY SNAPSHOT