-

Methodology and Scope

- Research Methodology

- Research Objective and Scope of the Report

-

Definition and Overview

-

Executive Summary

- Snippet by Product

- Snippet by Drug Type

- Snippet by Application

- Snippet by Region

-

Dynamics

- Impacting Factors

- Drivers

- Growing use of generic drugs among people

- Restraints

- High Logistics Cost

- Opportunity

- Impact Analysis

- Drivers

- Impacting Factors

-

Industry Analysis

- Porter’s Five Force Analysis

- Supply Chain Analysis

- Pricing Analysis

- Regulatory Analysis

- Production Analysis

- DMI Opinion

-

COVID-19 Analysis

- Analysis of COVID-19

- Scenario Before COVID

- Scenario During COVID

- Scenario Post COVID

- Pricing Dynamics Amid COVID-19

- Demand-Supply Spectrum

- Government Initiatives Related to the Market During Pandemic

- Manufacturers Strategic Initiatives

- Conclusion

- Analysis of COVID-19

-

By Product

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- Market Attractiveness Index, By Product

- Vials*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- Bottles

- Cartridges and Syringes

- Ampoules

- Others

- Introduction

-

By Drug Type

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- Market Attractiveness Index, By Drug Type

- Generic*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- Branded

- Biologic

- Introduction

-

By Application

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Attractiveness Index, By Application

- Biopharmaceutical companies*

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%)

- Biotechnology companies

- Research Organizations

- Others

- Introduction

-

By Region

- Introduction

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- Market Attractiveness Index, By Region

- North America

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- U.S.

- Canada

- Mexico

- Europe

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

- Introduction

- Key Region-Specific Dynamics

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- Introduction

-

Competitive Landscape

- Competitive Scenario

- Market Positioning/Share Analysis

- Mergers and Acquisitions Analysis

-

Company Profiles

- Gerresheimer AG

- Company Overview

- Product Portfolio and Description

- Financial Overview

- Key Developments

- Stevanato Group.

- NIPRO Corporation.

- SGD SA.

- Alphial S.r.l.

- Bormioli Pharma S.p.A.

- Ardagh Group

- Beatson Clark

- Vitro SAB

- Stoelzle Glass Group. (*LIST NOT EXHAUSTIVE)

- Gerresheimer AG

-

Appendix

- About Us and Services

- Contact Us

医薬品ガラス包装の世界市場2024-2031 |

| 【英語タイトル】Pharmaceutical Glass Packaging Market Size, Share, Industry, Forecast and outlook (2024-2031) | |

| ・商品コード:DAM529NE3313 ・発行会社(調査会社):DataM Intelligence ・発行日:2024年12月 ・ページ数:約180 ・レポート言語:英語 ・レポート形式:PDF ・納品方法:Eメール(受注後2営業日) ・調査対象地域:グローバル ・産業分野:医療 | |

| Single User(1名様閲覧用) | USD4,350 ⇒換算¥652,500 | 見積依頼/購入/質問フォーム |

| Multi User(5名様閲覧用) | USD4,850 ⇒換算¥727,500 | 見積依頼/購入/質問フォーム |

| Enterprise User(法人閲覧用) | USD7,850 ⇒換算¥1,177,500 | 見積依頼/購入/質問フォーム |

|

※販売価格オプションの説明 ※お支払金額:換算金額(日本円)+消費税 ※納期:即日〜2営業日(3日以上かかる場合は別途表記又はご連絡) ※お支払方法:納品日+5日以内に請求書を発行・送付(請求書発行日より2ヶ月以内に銀行振込、振込先:三菱UFJ銀行/H&Iグローバルリサーチ株式会社、支払期限と方法は調整可能) |

| グローバルな医薬品用ガラス包装市場は、医薬品の品質保持と安全性確保の観点から、今後も成長が見込まれています。特にガラスは化学的に安定しており、温度変化にも強いため、酸化や交差汚染のリスクを抑え、薬剤の有効性を長期間維持するのに適しています。このため、製薬業界ではガラス製のバイアル、アンプル、シリンジなどが広く使用されています。 近年、慢性疾患の増加や高齢化の進行、各国政府による医療費拡大が進む中、製薬業界は活況を呈しており、研究開発への投資も拡大しています。製薬企業は新薬の開発やパイプラインの強化に注力しており、それに伴い包装材の需要も増加。中でも、注射薬の需要増加が、ガラスバイアルの需要を押し上げています。 また、医療費の上昇により、価格の安いジェネリック医薬品の需要が世界的に増加しています。米国では処方薬の約90%がジェネリックであり、製薬会社はコスト削減のため大量生産に適したガラス包装を必要としています。これに応じて、ガラス包装メーカーは新技術やパートナーシップにより供給体制を強化しています。 ただし、ガラス包装には物流コストの高さという課題もあります。ガラスは割れやすく重量があるため、特別な梱包や高コストの輸送が必要です。そのため、軽量なプラスチック包装が好まれる傾向もありますが、高薬理活性物質には依然としてガラスが不可欠です。 市場ではバイアルが全体の45.5%を占めており、特にワクチン需要の高まりや即効性注射薬の増加が後押ししています。主要企業は新製品の投入を加速しており、SGD PharmaやCorning、West Pharmaceuticalなどが代表的な企業です。 地域別では北米が41.6%のシェアを持ち、最大市場となっています。ジェネリック・バイオシミラー薬による医療費削減効果が大きく、ガラス包装材の需要も堅調です。コロナ禍以降はワクチンの流通増により、ガラス容器の供給体制がより重要視されました。 競合環境では、Gerresheimer、Stevanato、NIPRO、SGD Pharmaなどの主要プレイヤーが技術開発や環境配慮型製品の展開を強化しており、持続可能性への対応も市場拡大の鍵となっています。 |

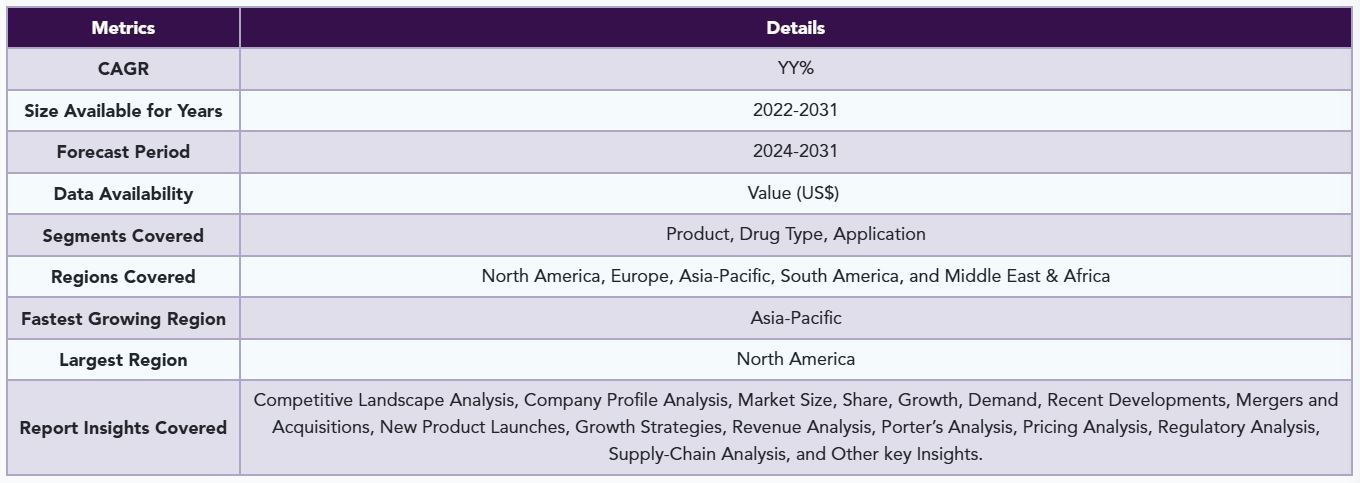

Global Pharmaceutical Glass Packaging Market reached US$ YY billion in 2022 and is expected to reach US$ YY billion by 2030 growing with a CAGR of YY% during the forecast period 2024-2031.

Glass packaging is extensively used in the pharmaceutical industry due to its nonreactive nature and resistance to temperatures. The shelf life of the product and its safety are important in the pharmaceutical industry and hence glass packaging is always preferred to safeguard the contents from oxidation and other reactions to prevent cross-contamination.

Glass packaging enhances the storage time and delivery of drugs which maintains the efficiency of the drug after a few days without any harmful effects. Due to the increasing access to healthcare costs, the demand for generic medicines has increased drastically due to the low costs. hence, the generic drug manufacturers will rely on glass packaging companies for bulk production.

The pharmaceutical sector is experiencing expansion due to causes including the rising prevalence of chronic diseases, an expanding senior population, increased healthcare expenditures by government entities worldwide, and significant initiatives to enhance the affordability of drugs. A May 2022 article indicates that US officials are prioritizing the affordability of prescription drugs since excessively high prices jeopardize consumer access to adequate care.

The expanding patient population and heightened demand for treatments and pharmaceuticals across diverse therapeutic areas globally are prompting major pharmaceutical companies to intensify their research and development efforts to enhance their portfolios and pipeline products. As of March 2022, Sanofi’s R&D pipeline included 91 clinical-stage compounds across multiple therapeutic areas, including oncology, autoimmune disorders, and neurology, with 34 currently in phase III trials or pending approval.

The growing incidence and awareness of chronic diseases, together with accessible treatment choices, are prompting major market participants to intensify their efforts in developing and launching new pharmaceuticals for numerous rare conditions. The expansion of the industry necessitates packaging for treatments of both communicable and non-communicable diseases. Consequently, the need for glass packaging in pharmaceutical manufacturing is rising due to its ability to safeguard medications against damage, biological contamination, and external factors.

The increasing demand for injectable medications is driving the expansion of glass bottles in the pharmaceutical sector. The robust demand for cancer and other high-potency pharmaceuticals, including antibody conjugates and rapidly acting steroids, together the increase in per capita pharmaceutical expenditure, is anticipated to be the principal catalysts for growth.

Market Segmentation

The pharmaceutical glass packaging is segmented based on product, drug type, application and region.

The Vials Segment Accounted for Approximately 45.5% of the Market Share

Vials are expected to hold the largest share in the market due to the rising demand for vaccines and other drugs. Parenteral route drugs are often packed in vials which are highly in demand due to its quick action on the target. Launch of the glass vials by glass packaging companies by collaborating with different pharmaceutical companies are driving the market. For instance, in March 2022, SGD Pharma launched ready-to-use sterile 100ml molded glass vials using SG EZ-fill packaging technology.

Furthermore, in July 2023, Corning Incorporated launched Corning Viridian Vials to expand its glass packaging portfolio. The new technology can improve filling-line efficiency by up to 50% while reducing vial-manufacturing carbon dioxide equivalent (CO2e) emissions by up to 30%.

In October 2023, West Pharmaceutical Services, Inc. collaborated with Corning Incorporated for the launch of the first product. The company holds the distribution rights for Corning Valor Glass vials.

| ★調査レポート[医薬品ガラス包装の世界市場2024-2031] (コード:DAM529NE3313)販売に関する免責事項を必ずご確認ください。 |

| ★調査レポート[医薬品ガラス包装の世界市場2024-2031]についてメールでお問い合わせ |