| 【英語タイトル】Biogas Plant Market Forecasts to 2030 - Global Analysis By Feedstock (Energy Crops, Agriculture Residue, Bio-Municipal Waste and Other Feedstocks), Digester Type (Dry Anaerobic Digestion and Wet Anaerobic Digestion), Application (Transportation, Heat Generation, Power Generation and Other Applications) and By Geography

|

| ・商品コード:SMRC774LM0234

・発行会社(調査会社):Stratistics MRC

・発行日:2024年6月

・ページ数:約200

・レポート言語:英語

・レポート形式:PDF

・納品方法:Eメール(受注後3営業日)

・調査対象地域:グローバル

・産業分野:環境、エネルギー

|

◆販売価格オプション

(消費税別)

※販売価格オプションの説明

※お支払金額:換算金額(日本円)+消費税

※納期:即日〜2営業日(3日以上かかる場合は別途表記又はご連絡)

※お支払方法:納品日+5日以内に請求書を発行・送付(請求書発行日より2ヶ月以内に銀行振込、振込先:三菱UFJ銀行/H&Iグローバルリサーチ株式会社、支払期限と方法は調整可能)

|

❖ レポートの概要 ❖

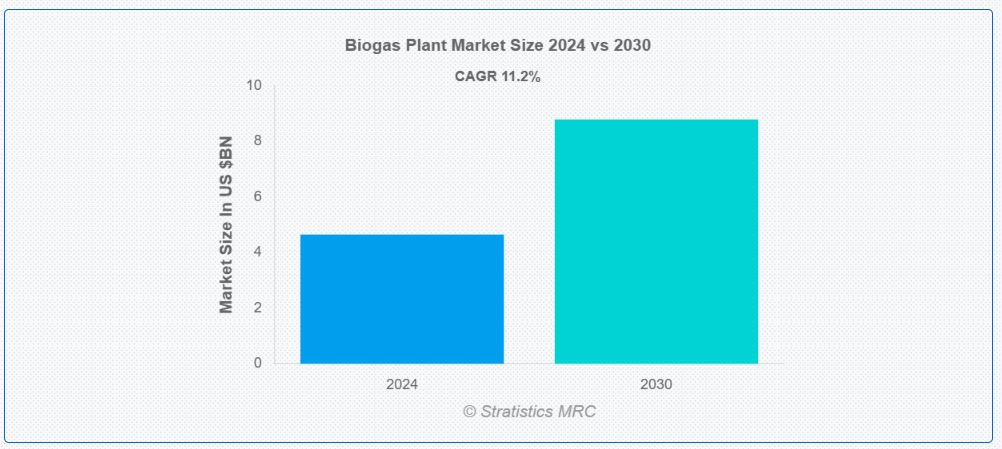

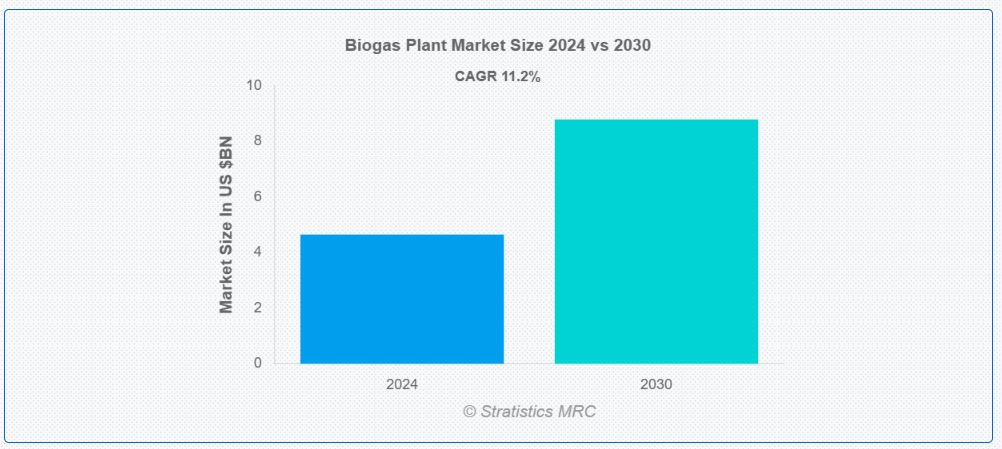

2024年の世界バイオガスプラント市場は約46億5,000万ドルで、2030年には87億9,000万ドルに達し、年平均成長率(CAGR)は11.2%と予測されています。バイオガスプラントは、農業廃棄物や動物の排せつ物、食品残渣などの有機廃棄物を嫌気性消化によってバイオガス(主にメタンと二酸化炭素)へと変換する施設であり、生成されたガスは発電・暖房・車両用燃料に活用されます。また副産物である消化液は肥料として利用可能です。

IEAによると、現在世界でバイオガスによる発電容量は19GW以上で、主にドイツ、アメリカ、イギリスに集中しています。欧州では、農作物由来8Mtoe、家畜ふん尿由来6Mtoe、一般廃棄物3Mtoe、下水1Mtoeといったバイオガス生産が報告されています。

市場成長の主因は廃棄物処理への関心の高まりで、バイオガス技術は持続可能な廃棄物管理と再生可能エネルギーの供給を同時に実現します。一方、初期投資の高さが普及の障壁であり、特に中小企業や発展途上国にとっては資金調達が課題です。ただし、気候変動への意識の高まりが市場に新たな機会をもたらし、特にバイオガスの温室効果ガス排出削減効果に注目が集まっています。技術的な複雑さや運用コストの高さは依然として課題です。

コロナ禍では、供給網の混乱により建設・保守に遅れが生じ、また有機廃棄物の供給も減少しましたが、持続可能なエネルギーの必要性が再認識され、市場の長期的成長が期待されています。

今後、最も大きな市場シェアを占めるのは農業残渣セグメントであり、農業廃棄物の有効活用によって温室効果ガス削減と農家の収入源拡大が期待されます。最も高い成長率を示すと見られるのは乾式嫌気性消化方式で、水を使わずに処理できる点からコスト削減や対象地域の拡大に寄与します。

地域別では、アジア太平洋地域が最大市場となり、欧州が最も高い成長を遂げると予測されています。特に欧州では政策支援や環境基準が普及を後押ししており、投資の安定性を確保しています。

主な企業には、Agraferm、Air Liquide、BioConstruct、EnviTec Biogas、Hitachi Zosen Inova、SUEZなどが含まれます。近年では、Weltec Biopowerが新しい制御システム「WB Control」を開発し、Amerescoがケンタッキー州で廃棄物由来ガスの商業運転を開始するなど、技術革新も進んでいます。 |

According to Stratistics MRC, the Global Biogas Plant Market is accounted for $4.65 billion in 2024 and is expected to reach $8.79 billion by 2030 growing at a CAGR of 11.2% during the forecast period. A biogas plant is a facility designed to convert organic waste materials, such as agricultural residues, animal manure, and food scraps, into biogas through the process of anaerobic digestion. In this process, microorganisms break down the organic matter in the absence of oxygen, producing a mixture of methane and carbon dioxide, commonly referred to as biogas. The biogas can be used as a renewable source of energy for heating, electricity generation, and as a vehicle fuel. Additionally, the residual byproduct, known as digestate, can be utilized as a nutrient-rich fertilizer.

According to the International Energy Agency (IEA), currently, more than 19 GW of installed power generation capacity is running on biogas worldwide, most of which are in Germany, the U.S., and the U.K. According to the International Energy Agency report of 2018, Europe produces 8 Mtoe biogas from crops, 6 Mtoe from animal manure, 3 Mtoe from municipal solid waste, and 1 Mtoe from municipal wastewater.

Market Dynamics:

Driver:

Growing concerns about waste management

Growing concerns about waste management are driving the expansion of the biogas plant market. With increasing awareness about the environmental impacts of conventional waste disposal methods like landfills and incineration, there’s a pressing need for sustainable alternatives. Biogas plants offer a solution by converting organic waste materials into renewable energy sources such as biogas and biofertilizers through anaerobic digestion. This process not only reduces the volume of waste going to landfills but also produces clean energy and nutrient-rich fertilizers.

Restraint:

High initial investment

The high initial investment required for establishing biogas plants presents a significant barrier to entry, hindering the market’s growth. Biogas plants necessitate substantial capital for construction, equipment procurement, and infrastructure development. This financial burden often deters potential investors, especially small-scale enterprises and developing nations, from participating in the market. Securing financing for such projects can be challenging due to perceived risks associated with biogas technology, uncertain returns on investment, and lengthy payback periods.

Opportunity:

Growing awareness of climate change

Biogas, produced through anaerobic digestion of organic materials like agricultural waste, sewage, and food scraps, offers a renewable energy alternative with lower carbon emissions compared to fossil fuels. As nations strive to reduce their carbon footprint and meet emissions targets outlined in international agreements like the Paris Agreement, there’s a heightened focus on adopting eco-friendly energy solutions. Biogas plants not only mitigate greenhouse gas emissions by capturing methane, a potent contributor to global warming, but they also provide a versatile energy source for electricity generation, heating, and transportation fuel.

Threat:

Complexity of technology

Biogas technology involves intricate processes such as anaerobic digestion and gas purification, which require specialized knowledge and equipment. This complexity increases the initial investment and operational costs, making it less attractive for potential investors and operators. However, the technical expertise required for designing, constructing, and maintaining biogas plants can be a barrier for entry into the market, especially for small-scale projects and rural communities.

Covid-19 Impact:

Initially, disruptions in the global supply chain caused delays in the construction of new biogas plants and hindered the maintenance of existing ones. Lockdown measures and reduced economic activity also led to a decrease in organic waste generation from industries and households, affecting feedstock availability for biogas production. The uncertainty surrounding the pandemic caused a slowdown in investment in renewable energy projects, including biogas plants. However, amidst these challenges, the pandemic also highlighted the importance of sustainable waste management and renewable energy sources, leading to renewed interest and potential long-term growth prospects for the biogas plant market as governments and industries seek resilient and environmentally friendly solutions for energy generation and waste management in the post-pandemic era.

The Agriculture Residue segment is expected to be the largest during the forecast period

Agriculture Residue segment is expected to be the largest during the forecast period. Agricultural residues, such as crop residues, animal manure, and organic waste, serve as excellent feedstocks for biogas production. Biogas plants utilize anaerobic digestion processes to convert these residues into biogas, a renewable energy source primarily composed of methane and carbon dioxide. With increasing concerns about climate change and the need for sustainable energy solutions, biogas generated from agriculture residues offers a promising avenue for reducing greenhouse gas emissions and dependence on fossil fuels. Moreover, the utilization of agricultural residues for biogas production provides an additional revenue stream for farmers and helps in waste management by diverting organic waste from landfills.

The Dry Anaerobic Digestion segment is expected to have the highest CAGR during the forecast period

Dry Anaerobic Digestion segment is expected to have the highest CAGR during the forecast period. Unlike traditional wet AD systems, which require significant amounts of water, dry AD processes operate without the need for liquid substrates. This characteristic significantly reduces operational costs and simplifies logistics, making biogas production more accessible to a wider range of industries and regions. Additionally, dry AD systems are more versatile in the types of feedstock they can process, including organic waste streams with higher solid content. This flexibility expands the potential feedstock sources for biogas production, such as agricultural residues, food waste, and organic industrial by-products.

Region with largest share:

Asia Pacific region dominated the largest share over the extrapolated period by promoting sustainable waste management and energy production. Biogas plants utilize organic waste materials to generate renewable energy, reducing reliance on fossil fuels and mitigating environmental degradation. These initiatives encourage the regional adoption of biogas technology across industries, fostering a closed-loop system where waste is transformed into valuable resources. Moreover, they stimulate economic growth by creating new job opportunities in the renewable energy sector and reducing waste disposal costs for businesses.

Region with highest CAGR:

Europe region is estimated to witness substantial growth during the projection time frame. Government regulations are designed to promote sustainable energy practices and reduce greenhouse gas emissions, aligning with the region’s commitment to combat climate change. By implementing policies such as feed-in tariffs, renewable energy targets, and financial incentives for biogas production, governments encourage investment in biogas infrastructure and technology across the region. Additionally, stringent environmental standards ensure that biogas plants operate in an environmentally responsible manner, minimizing their impact on ecosystems and surrounding communities. This regulatory framework provides stability and certainty for investors, driving the expansion of the biogas industry across Europe.

Key players in the market

Some of the key players in Biogas Plant market include Agraferm GmbH, Air Liquide SA, BioConstruct GmbH, BioEnergy International GmbH, EnviTec Biogas AG, Hitachi Zosen Inova AG, Schmack Biogas GmbH, SP Renewable Energy Sources Pvt. Ltd, StormFisher Environmental Ltd and SUEZ Recycling & Recovery Holdings.

Key Developments:

In February 2024, Weltec Biopower is developing a new user interface for biogas plant control systems. The parts of the control system known as LoMode and CeMode will be combined under the new name WB Control in the future. WB Control can be used in both small and complex industrial systems. The web-based software gives users complete and quick access to all important system parameters. A customizable dashboard provides a quick overview of the most important process information at any time. WB Control can be used by multiple users simultaneously.

In October 2023, Ameresco Inc., a clean technology integrator of energy efficiency and renewable energy, has entered commercial operation with a landfill gas (LFG) renewable natural gas facility at Republic Services’ Benson Valley Landfill in Frankfort, Kentucky. The Benson Valley facility has a rated capacity of more than 483,552 dekatherms per year and is capable of processing 2,000 standard cubic feet per minute of crude LFG.

Feedstocks Covered:

• Energy Crops

• Agriculture Residue

• Bio-Municipal Waste

• Other Feedstocks

Digester Types Covered:

• Dry Anaerobic Digestion

• Wet Anaerobic Digestion

Applications Covered:

• Transportation

• Heat Generation

• Power Generation

• Other Applications

Regions Covered:

• North America

o US

o Canada

o Mexico

• Europe

o Germany

o UK

o Italy

o France

o Spain

o Rest of Europe

• Asia Pacific

o Japan

o China

o India

o Australia

o New Zealand

o South Korea

o Rest of Asia Pacific

• South America

o Argentina

o Brazil

o Chile

o Rest of South America

• Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Rest of Middle East & Africa

What our report offers:

– Market share assessments for the regional and country-level segments

– Strategic recommendations for the new entrants

– Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

– Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

– Strategic recommendations in key business segments based on the market estimations

– Competitive landscaping mapping the key common trends

– Company profiling with detailed strategies, financials, and recent developments

– Supply chain trends mapping the latest technological advancements

1 Executive Summary

2 Preface

2.1 Abstract

2.2 Stake Holders

2.3 Research Scope

2.4 Research Methodology

2.4.1 Data Mining

2.4.2 Data Analysis

2.4.3 Data Validation

2.4.4 Research Approach

2.5 Research Sources

2.5.1 Primary Research Sources

2.5.2 Secondary Research Sources

2.5.3 Assumptions

3 Market Trend Analysis

3.1 Introduction

3.2 Drivers

3.3 Restraints

3.4 Opportunities

3.5 Threats

3.6 Application Analysis

3.7 Emerging Markets

3.8 Impact of Covid-19

4 Porters Five Force Analysis

4.1 Bargaining power of suppliers

4.2 Bargaining power of buyers

4.3 Threat of substitutes

4.4 Threat of new entrants

4.5 Competitive rivalry

5 Global Biogas Plant Market, By Feedstock

5.1 Introduction

5.2 Energy Crops

5.3 Agriculture Residue

5.4 Bio-Municipal Waste

5.5 Other Feedstocks

6 Global Biogas Plant Market, By Digester Type

6.1 Introduction

6.2 Dry Anaerobic Digestion

6.3 Wet Anaerobic Digestion

7 Global Biogas Plant Market, By Application

7.1 Introduction

7.2 Transportation

7.3 Heat Generation

7.4 Power Generation

7.5 Other Applications

8 Global Biogas Plant Market, By Geography

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 Italy

8.3.4 France

8.3.5 Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.2 China

8.4.3 India

8.4.4 Australia

8.4.5 New Zealand

8.4.6 South Korea

8.4.7 Rest of Asia Pacific

8.5 South America

8.5.1 Argentina

8.5.2 Brazil

8.5.3 Chile

8.5.4 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 Qatar

8.6.4 South Africa

8.6.5 Rest of Middle East & Africa

9 Key Developments

9.1 Agreements, Partnerships, Collaborations and Joint Ventures

9.2 Acquisitions & Mergers

9.3 New Product Launch

9.4 Expansions

9.5 Other Key Strategies

10 Company Profiling

10.1 Agraferm GmbH

10.2 Air Liquide SA

10.3 BioConstruct GmbH

10.4 BioEnergy International GmbH

10.5 EnviTec Biogas AG

10.6 Hitachi Zosen Inova AG

10.7 Schmack Biogas GmbH

10.8 SP Renewable Energy Sources Pvt. Ltd

10.9 StormFisher Environmental Ltd

10.10 SUEZ Recycling & Recovery Holdings

List of Tables

1 Global Biogas Plant Market Outlook, By Region (2022-2030) ($MN)

2 Global Biogas Plant Market Outlook, By Feedstock (2022-2030) ($MN)

3 Global Biogas Plant Market Outlook, By Energy Crops (2022-2030) ($MN)

4 Global Biogas Plant Market Outlook, By Agriculture Residue (2022-2030) ($MN)

5 Global Biogas Plant Market Outlook, By Bio-Municipal Waste (2022-2030) ($MN)

6 Global Biogas Plant Market Outlook, By Other Feedstocks (2022-2030) ($MN)

7 Global Biogas Plant Market Outlook, By Digester Type (2022-2030) ($MN)

8 Global Biogas Plant Market Outlook, By Dry Anaerobic Digestion (2022-2030) ($MN)

9 Global Biogas Plant Market Outlook, By Wet Anaerobic Digestion (2022-2030) ($MN)

10 Global Biogas Plant Market Outlook, By Application (2022-2030) ($MN)

11 Global Biogas Plant Market Outlook, By Transportation (2022-2030) ($MN)

12 Global Biogas Plant Market Outlook, By Heat Generation (2022-2030) ($MN)

13 Global Biogas Plant Market Outlook, By Power Generation (2022-2030) ($MN)

14 Global Biogas Plant Market Outlook, By Other Applications (2022-2030) ($MN)

15 North America Biogas Plant Market Outlook, By Country (2022-2030) ($MN)

16 North America Biogas Plant Market Outlook, By Feedstock (2022-2030) ($MN)

17 North America Biogas Plant Market Outlook, By Energy Crops (2022-2030) ($MN)

18 North America Biogas Plant Market Outlook, By Agriculture Residue (2022-2030) ($MN)

19 North America Biogas Plant Market Outlook, By Bio-Municipal Waste (2022-2030) ($MN)

20 North America Biogas Plant Market Outlook, By Other Feedstocks (2022-2030) ($MN)

21 North America Biogas Plant Market Outlook, By Digester Type (2022-2030) ($MN)

22 North America Biogas Plant Market Outlook, By Dry Anaerobic Digestion (2022-2030) ($MN)

23 North America Biogas Plant Market Outlook, By Wet Anaerobic Digestion (2022-2030) ($MN)

24 North America Biogas Plant Market Outlook, By Application (2022-2030) ($MN)

25 North America Biogas Plant Market Outlook, By Transportation (2022-2030) ($MN)

26 North America Biogas Plant Market Outlook, By Heat Generation (2022-2030) ($MN)

27 North America Biogas Plant Market Outlook, By Power Generation (2022-2030) ($MN)

28 North America Biogas Plant Market Outlook, By Other Applications (2022-2030) ($MN)

29 Europe Biogas Plant Market Outlook, By Country (2022-2030) ($MN)

30 Europe Biogas Plant Market Outlook, By Feedstock (2022-2030) ($MN)

31 Europe Biogas Plant Market Outlook, By Energy Crops (2022-2030) ($MN)

32 Europe Biogas Plant Market Outlook, By Agriculture Residue (2022-2030) ($MN)

33 Europe Biogas Plant Market Outlook, By Bio-Municipal Waste (2022-2030) ($MN)

34 Europe Biogas Plant Market Outlook, By Other Feedstocks (2022-2030) ($MN)

35 Europe Biogas Plant Market Outlook, By Digester Type (2022-2030) ($MN)

36 Europe Biogas Plant Market Outlook, By Dry Anaerobic Digestion (2022-2030) ($MN)

37 Europe Biogas Plant Market Outlook, By Wet Anaerobic Digestion (2022-2030) ($MN)

38 Europe Biogas Plant Market Outlook, By Application (2022-2030) ($MN)

39 Europe Biogas Plant Market Outlook, By Transportation (2022-2030) ($MN)

40 Europe Biogas Plant Market Outlook, By Heat Generation (2022-2030) ($MN)

41 Europe Biogas Plant Market Outlook, By Power Generation (2022-2030) ($MN)

42 Europe Biogas Plant Market Outlook, By Other Applications (2022-2030) ($MN)

43 Asia Pacific Biogas Plant Market Outlook, By Country (2022-2030) ($MN)

44 Asia Pacific Biogas Plant Market Outlook, By Feedstock (2022-2030) ($MN)

45 Asia Pacific Biogas Plant Market Outlook, By Energy Crops (2022-2030) ($MN)

46 Asia Pacific Biogas Plant Market Outlook, By Agriculture Residue (2022-2030) ($MN)

47 Asia Pacific Biogas Plant Market Outlook, By Bio-Municipal Waste (2022-2030) ($MN)

48 Asia Pacific Biogas Plant Market Outlook, By Other Feedstocks (2022-2030) ($MN)

49 Asia Pacific Biogas Plant Market Outlook, By Digester Type (2022-2030) ($MN)

50 Asia Pacific Biogas Plant Market Outlook, By Dry Anaerobic Digestion (2022-2030) ($MN)

51 Asia Pacific Biogas Plant Market Outlook, By Wet Anaerobic Digestion (2022-2030) ($MN)

52 Asia Pacific Biogas Plant Market Outlook, By Application (2022-2030) ($MN)

53 Asia Pacific Biogas Plant Market Outlook, By Transportation (2022-2030) ($MN)

54 Asia Pacific Biogas Plant Market Outlook, By Heat Generation (2022-2030) ($MN)

55 Asia Pacific Biogas Plant Market Outlook, By Power Generation (2022-2030) ($MN)

56 Asia Pacific Biogas Plant Market Outlook, By Other Applications (2022-2030) ($MN)

57 South America Biogas Plant Market Outlook, By Country (2022-2030) ($MN)

58 South America Biogas Plant Market Outlook, By Feedstock (2022-2030) ($MN)

59 South America Biogas Plant Market Outlook, By Energy Crops (2022-2030) ($MN)

60 South America Biogas Plant Market Outlook, By Agriculture Residue (2022-2030) ($MN)

61 South America Biogas Plant Market Outlook, By Bio-Municipal Waste (2022-2030) ($MN)

62 South America Biogas Plant Market Outlook, By Other Feedstocks (2022-2030) ($MN)

63 South America Biogas Plant Market Outlook, By Digester Type (2022-2030) ($MN)

64 South America Biogas Plant Market Outlook, By Dry Anaerobic Digestion (2022-2030) ($MN)

65 South America Biogas Plant Market Outlook, By Wet Anaerobic Digestion (2022-2030) ($MN)

66 South America Biogas Plant Market Outlook, By Application (2022-2030) ($MN)

67 South America Biogas Plant Market Outlook, By Transportation (2022-2030) ($MN)

68 South America Biogas Plant Market Outlook, By Heat Generation (2022-2030) ($MN)

69 South America Biogas Plant Market Outlook, By Power Generation (2022-2030) ($MN)

70 South America Biogas Plant Market Outlook, By Other Applications (2022-2030) ($MN)

71 Middle East & Africa Biogas Plant Market Outlook, By Country (2022-2030) ($MN)

72 Middle East & Africa Biogas Plant Market Outlook, By Feedstock (2022-2030) ($MN)

73 Middle East & Africa Biogas Plant Market Outlook, By Energy Crops (2022-2030) ($MN)

74 Middle East & Africa Biogas Plant Market Outlook, By Agriculture Residue (2022-2030) ($MN)

75 Middle East & Africa Biogas Plant Market Outlook, By Bio-Municipal Waste (2022-2030) ($MN)

76 Middle East & Africa Biogas Plant Market Outlook, By Other Feedstocks (2022-2030) ($MN)

77 Middle East & Africa Biogas Plant Market Outlook, By Digester Type (2022-2030) ($MN)

78 Middle East & Africa Biogas Plant Market Outlook, By Dry Anaerobic Digestion (2022-2030) ($MN)

79 Middle East & Africa Biogas Plant Market Outlook, By Wet Anaerobic Digestion (2022-2030) ($MN)

80 Middle East & Africa Biogas Plant Market Outlook, By Application (2022-2030) ($MN)

81 Middle East & Africa Biogas Plant Market Outlook, By Transportation (2022-2030) ($MN)

82 Middle East & Africa Biogas Plant Market Outlook, By Heat Generation (2022-2030) ($MN)

83 Middle East & Africa Biogas Plant Market Outlook, By Power Generation (2022-2030) ($MN)

84 Middle East & Africa Biogas Plant Market Outlook, By Other Applications (2022-2030) ($MN)